Note: Some of the VA spot ETFs offer unlisted class units which operate very similarly to unlisted VA spot funds. Relevant investors should also refer to information and key risks herein before making an investment decision in these unlisted class units / funds.

Virtual asset spot ETFs are now listed and traded on HKEX. These products may provide investors who wish to gain exposure to virtual assets (VA) a listed product option.

A VA spot ETF obtains exposure to VA by directly holding VA. Currently, VA spot ETFs authorised by the SFC are only allowed to invest in VAs that are accessible to Hong Kong public for trading on SFC-licensed virtual asset trading platforms (VATPs). In addition, these VA spot ETFs can only trade VA on SFC-licensed VATPs and safekeep the VA holdings at locally regulated entities, such as SFC-licensed VATPs, banks or their locally incorporated subsidiaries. These measures are designed to protect investors against the novel risks associated with VA.

You should note that VA are a relatively new asset class with limited history. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. In particular, the value of VA could decline significantly in a short period of time, even to zero. For example, in 2020, the biggest single-day drop of the price of bitcoin was 39%*. You may lose all of your investment in a VA spot ETF within one day.

You should know how VA and VA spot ETF work and the risks involved before making an investment decision. Intermediaries will also assess whether you have knowledge of investing in VA or VA-related products before effecting a transaction in VA spot ETFs on your behalf. The following pointers help you understand more about this type of products.

- A VA spot ETF is directly exposed to the risks of the underlying VA, such as VA’s highly speculative nature, VA prices’ extreme volatility which are affected by numerous events or factors that are unforeseeable, and the evolving and increasing regulations on VA, etc.

- A VA spot ETF is targeted at investors who understand its nature and risks, such as:

- extremely high price volatility of VA as the value of the VA may decline significantly, even to zero;

- risk relating to the VA, including changes in acceptance of VA, regulatory risk, cybersecurity risk, fork risk, potential manipulation risk, concentration of ownership risk, liquidity risk of VATPs and any unforeseeable risk due to the evolving nature of VA;

- concentration risk in a single reference asset (e.g., bitcoin or ether); and

- custody risk and the difficulties in recovery in case of theft or loss.

- You should exercise caution when trading a VA spot ETF. You may lose all of your investment in a VA spot ETF within one day. Before investing in such an ETF, you should read this page and its offering documents carefully and fully understand its features, exposure, operation and risks.

- Investment in VA spot ETFs should only be ancillary in your portfolio because they are highly volatile and do not necessarily provide any diversification effect.

- If you are not prepared to accept significant and unexpected changes in the value of a VA spot ETF (including dropping to zero) and the possibility that you could lose your entire investment in the VA spot ETF, you should not invest in it.

Key facts about VA

VA are digital representations of value which may be in the form of digital tokens (such as utility tokens or asset-backed tokens), any other virtual commodities, crypto assets or other assets of essentially the same nature. VA may be (or are often claimed to be) a means of payment, may confer a right to present or future earnings or enable the VA holder to access a product or service, or a combination of any of these functions. Two of the more popular VA are bitcoin and ether.

VA, including bitcoin and ether, are typically based on distributed ledger technology that offers an anonymous way to digitally record their ownership and facilitates peer-to-peer trading. They are “stored” on a digital transaction ledger commonly known as a “blockchain”, where the ownership and transaction records are protected through public-key cryptography. While proponents of VA have identified various potential benefits, critics also raised a number of concerns, such as high price volatility, custody risk, no guarantee or backing by authorities and banks, fraud, cybersecurity risk, trading on less regulated or unregulated platforms and their potential association with illegal activities. In particular, over the course of history of VA, some of the major players, including trading platforms and lending platforms that were less regulated and lacked transparency on their financial soundness, collapsed due to mismanagement and potential fraud. These events resulted in significant losses to related VA investors. Compared to conventional investment assets such as equities and bonds, risks of investing in VA and VA-related products are unique and substantial. For more details, please refer to the virtual assets page.

How does a VA spot ETF work?

A VA spot ETF (such as a bitcoin spot ETF or an ether spot ETF) obtains exposure to VA through directly holding VA (such as bitcoin or ether). VA spot ETFs generally track an underlying index (in the case of passively managed VA spot ETFs) or adopt a valuation index which reflects the spot price of VA by aggregating trade flow across constituent platforms (not necessarily licensed by the SFC). Such constituent platforms are chosen based on their liquidity, data quality and transparency.

VA spot ETFs in Hong Kong are only allowed to invest in VA that are accessible to Hong Kong public for trading on SFC-licensed VATPs. Transactions and acquisitions of spot VA can only be conducted through SFC-licensed VATPs or authorised financial institutions regulated by HKMA. More specifically:

- for in-cash creation and redemption, VA spot ETFs are expected to acquire and dispose spot VA through SFC-licensed VATPs; and

- for in-kind creation and redemption, participating dealers are expected to transfer spot VA (which may be held locally or overseas) to the VA spot ETFs’ custody accounts with SFC-licensed VATPs or authorised financial institutions.

In addition, VA spot ETFs in Hong Kong are required to safekeep their VA custody holdings with custodians who are either SFC-licensed VATPs or authorised financial institutions regulated by HKMA. For risks related to custody of VA, please refer to the section “Key risks” below for more details.

The regulatory regime for VA spot ETFs in Hong Kong seeks to address the novel investor protection concerns associated with VA by limiting dealings with entities regulated by the SFC or HKMA for transactions and custody of VA.

Key risks

Apart from the major risks of ETFs, investors should be aware of the below risks when trading VA spot ETFs.

Risk related to the underlying VA

VA spot ETFs are directly exposed to the risks of the underlying VA. VA prices are extremely volatile and affected by numerous events or factors that are unforeseeable and potentially difficult to evaluate. They include changes in overall market sentiment, changes in acceptance of the VA, regulatory changes, security failures of the underlying network or related trading platforms, related fraud, market manipulation, contagious effect from collapses of major players in the VA market and other further development of the underlying network. In particular,

- VA is a relatively new innovation and part of a rapidly changing industry. VA and the VA industry are therefore subject to substantial speculative interest, rapid price swings and uncertainty. In addition, VA operates without central authority (such as a bank) and is generally not backed by government. The slowing, stopping or reversing of the development or acceptance of a particular VA may adversely affect the VA’s price.

- VA is vulnerable to cybersecurity attack. Cybersecurity risks relating to a VA’s underlying network and entities that provide custody or facilitate the trading of the VA may result in a loss of public confidence in the VA and a decline in the value of the VA. In particular, malicious actors may exploit flaws in the VA’s underlying network to, among other things, steal VA held by others, control the network or issue significant amounts of the VA in contravention of the network protocols. The occurrence of any of these events is likely to have a significant adverse impact on the value and liquidity of the VA.

-

As VA network is generally an open-source project, the developers may suggest changes to a particular VA’s software from time to time. If the updated software is not compatible with the original software and a sufficient number (but not necessarily a majority) of users and miners elect not to migrate to the updated software, this would result in a “hard fork” of the VA’s network, with one prong running the earlier version of the software and the other running the updated software, resulting in the existence of two versions of VA network running in parallel and a split of the blockchain underlying the VA network. This could impact demand for the VA and adversely impact the VA’s prices.

- The market for VA traded on SFC-licensed VATPs is still developing and may be subject to period of illiquidity. Such liquidity risk may be caused by the absence of buyers, limited buy/sell activity, underdeveloped secondary markets, regulatory changes, cybersecurity issues, etc. During such times, there may be delays in the VA spot ETFs’ ability to acquire or dispose VA from the relevant SFC-licensed VATPs.

- There may be concentration of ownership risk in the VA market as the largest wallets are believed to hold a significant percentage of the VA in circulation. Large sales by such holders could have an adverse effect on the market price of the relevant VA. (What is virtual asset wallet?)

- The regulation of VA, related products and services continues to evolve. Potential regulatory changes and actions with respect to VA generally or any single VA in particular may alter, potentially to a materially adverse extent, the nature of the investment of VA spot ETFs and may adversely impact their values.

Under exceptional market circumstances, the price of VA may drop significantly, even to zero, in a short period of time. For example, in 2020, the biggest single-day drop of the price of bitcoin was 39%*. An investor should be prepared to lose the full principal value of their investment in VA spot ETFs within a single day.

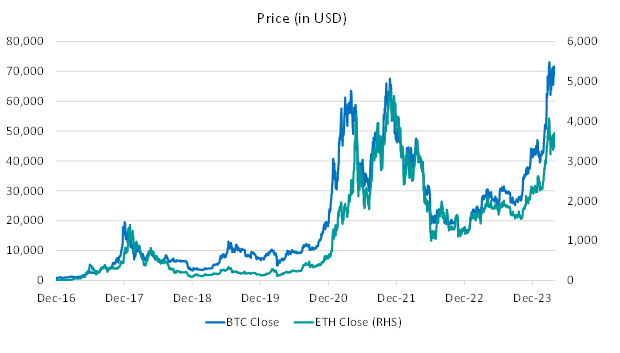

Historically, the prices of bitcoin / ether have been extremely volatile. Their price volatilities are much higher than stocks, bonds and other conventional commodities. As illustrated in the chart below, between 22 November 2020 and 22 November 2021, the prices of bitcoin and ether rose by 206% and 633% respectively. However, in the year that followed (i.e. from 22 November 2021 to 22 November 2022), the prices of bitcoin and ether fell by 71% and 72% respectively.

VA custody risk

While the custodians safekeeping the VA holdings of VA spot ETFs (VA Custodians) are regulated by the SFC and HKMA, there can be no assurance that their security procedures will actually work as designed or prove to be successful in safeguarding the ETFs’ assets against all possible sources of theft, loss or damage.

While the VA Custodians are required to store most of their VA in cold wallet (i.e. where the private keys to the wallet are kept in an offline environment), some of the VA may be temporarily held online in the hot wallet (i.e. where the private keys to the wallet are kept in an online environment) for the needs of creations and redemptions, which is more susceptible to cyber-attacks.

The VA spot ETF itself does not insure its holdings in VA while the VA Custodians are required to maintain a compensation arrangement to cover potential losses of client’s VA. In case of theft or loss, the compensation arrangement of the VA Custodians may not be adequate to cover all VA held on behalf of the virtual asset spot ETF.

Risk of volatility of a single asset

A VA spot ETF has risk exposure concentrated in the VA market. Unlike conventional ETFs that track equity indices which are typically diversified, a VA spot ETF may be subject to the price volatility of a single asset only (e.g., bitcoin or ether). Such volatility may be extremely high and substantially higher than the volatility experienced by equity indices or a commodity index which is made up of multiple types of commodities.

Difference between executable price of VA on SFC-licensed VATPs and valuation price for creation and redemption

Given the executable price of VA on the SFC-licensed VATPs may not be the same as the traded prices of VA on the constituent platforms used by the VA index for valuation, depending on the circumstance, this may impact participating dealers and market makers’ ability to conduct effective arbitrage and provide liquidity on VA spot ETFs, which may lead to higher premium or discount to NAV and/or higher bid-ask spread of the ETFs in secondary market. This may also lead to higher tracking difference.

Trading risks

Each of the SFC-licensed VATPs and the constituent platforms used by the VA index is a 24-hour marketplace. However, the VA spot ETFs in Hong Kong are only traded and priced during HKEX trading hours. As a result, the value of the VA in the ETFs’ portfolio may change on such day or time when investors will not be able to purchase or sell the ETF units. Where the VA spot ETF’s valuation point is outside Asian trading hours, there would be a higher likelihood for it to be traded at a substantial premium or discount to the day-end NAV, compared to funds investing in conventional underlying assets like equities or bonds.

*Based on daily prices of bitcoin against USD on Bloomberg, at GMT 00:00.

30 April 2024