More on bonds

Common Types of Bonds

- Corporate bonds are issued by companies or their subsidiaries to finance their business activities.

- Government bonds are issued by the government. Government bonds are usually considered lower risk investments because of the relatively lower chance of default by a government.

- Perpetual bonds do not have a fixed maturity date but they pay a steady stream of interest forever.

- Callable bonds grant the issuer the right to repay the bond before it matures.

- Puttable bonds give you the right to sell the bond back to the issuer at a predetermined price.

- Convertible bonds give you the right to convert the bond into a specified number of unissued shares of the issuer or a related company.

- Exchangeable bonds allow you to exchange the bond for the shares of any organisation which are already in issue and held by the issuer or a related company.

Bond yields

When you invest in bonds, looking at the price and coupon rate isn't enough - you need to use yield to compare the return with that of other bonds. For bonds with similar terms and credit ratings, the higher the yield, the more attractive the bond. Price and coupon rate are then used to fine-tune the choice of your bond. Actual yield of bonds will depend on the subscription or purchase price and may be higher or lower than the specified coupon rate. Current yield, yield to maturity (YTM), and yield to call (YTC) are the three commonly used bond yield measures.

- Current yield - the annualised rate of return calculated by simply dividing the current annual coupon of a bond by its price.

- YTM - the rate of return anticipated on a bond if it is held until maturity. YTM is usually expressed as an annual rate of return.

- YTC - the rate of return of a callable bond which is held until the call date. The yield will only become valid if the bond is called before maturity.

The yield is the actual return on your investment. Don't be fooled by a high coupon rate which is not reflected in the yield.

Don't consider a bond solely because of its high yield. There are many reasons why a bond with a high yield may not be a suitable investment. Generally, issuers of low-rated bonds need to offer higher interest rates to entice investors. Also, a bond with longer maturity normally has a higher yield unless the yield curve is inverted at the time of issue. You have to be comfortable with the additional risks that you are taking.

Bond Price

Price of bonds trading in the secondary market can vary due to a number of factors. The yield will change accordingly. Generally, the relationship between yield and price is as follows:

- If you buy a bond at par and hold it until it matures, then the yield is the same as the coupon rate.

- When a bond sells for more than its par value, i.e. at a premium, the yield is lower than the coupon rate.

- When a bond is bought at a discount (below par value), the yield is higher than the coupon rate.

Credit rating of bonds

When you buy a bond, you become a creditor of the issuer. The issuer's creditworthiness reflects its ability to pay you what you're owed which, in the case of a bond, is the interest and/or the principal. Some bonds may have a guarantor to back the obligations and liabilities of the issuer. Investors can also refer to the credit rating of the issuer of the bonds, or of the bonds themselves, assigned by credit rating agencies, such as Standard & Poor's, Moody's, etc. The credit rating agencies will assign higher rating to the bonds which, in their opinion, the bondholder may have a better chance of receiving a payment for the principal and interest of the bond. However, investors should be aware that the credit rating is only an opinion of the particular credit rating agency and may change from time to time.

The yield on a bond is influenced by the credit risk of the bond. In general, the higher the credit risk, the higher is its yield due to the higher credit spread. Credit spread is the additional risk premium (Note) that investors demand for holding the bond. Therefore, non-investment grade bonds are also called high yield bonds or junk bonds due to the fact that they offer higher yield for the higher risks they carry.

Consult your intermediary for the latest credit rating of bonds. Credit rating agencies look at other debt the issuer has, its financial condition - how fast the issuer's revenues and profits are growing, and how well other companies in the same business are doing etc. Their primary concern is to alert investors to the risks of a particular issue.

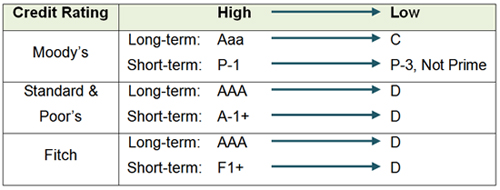

Each credit rating agency has defined its own credit rating scale and separate sets of scale for long term and short term bonds. The table below shows a high level summary of credit rating agencies' credit rating scales for your reference. You can find detailed descriptions for individual ratings at respective credit agencies' websites. Remember to use the same rating scale when making comparisons.

|

Note: Risk premium refers to the additional return on top of a risk-free interest rate you expect from a risky investment.