Leverage risk when investing in London Gold

Ruling out the risk of falling victim to scams, is London Gold well worth our investment?

Unlike physical gold, paper gold schemes and gold ETFs, London Gold is a highly- leveraged investment vehicle that is merely used for short-term speculation on gold prices. Since very high risks are involved, London Gold is not suitable for the typical retail investor.

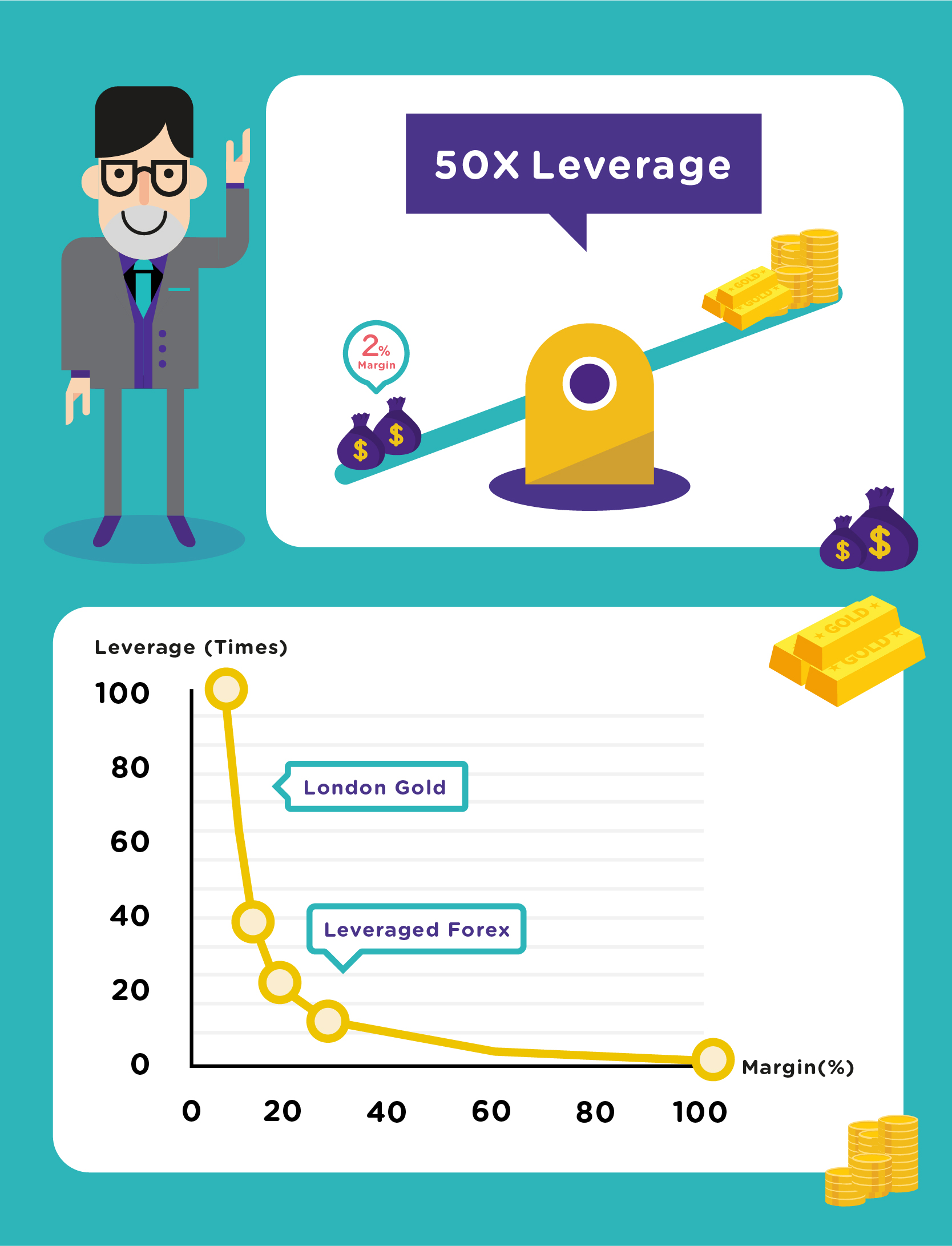

Understanding leverage effect

Physical gold, paper gold schemes and gold ETFs are not traded on margin and hence do not involve leverage. Taking out transaction costs, gains or losses will be in the same magnitude of the rise and fall of the gold price. However, London Gold is traded on margin. Investors are only required to deposit a small percentage of the contract value instead of the full amount.

For leveraged forex, the minimum initial margin requirement is 5% of the contract amount of each contract. In other words, the maximum leverage (1/0.05) is equivalent to 20 times of the minimum initial margin. There is no such requirement on London Gold trading. The initial margin for opening a contract can be as low as US$1,000 or below. Assuming the gold price is US$1,300, then each London Gold contract is worth US$130,000, and the initial margin is less than 1% of the contract amount. In other words, the leverage effect is over 100 times.

With London Gold trading, the leverage effect will magnify your gains and losses significantly. In the event of high leverage, a small movement in gold price may result in profit or loss that is high in proportion to the margin deposit. For example, if you expect gold price to rise and pay 1% deposit to buy a London Gold contract, then the leverage is 100 times. If the price of London Gold drops by 1%, you will lose 100% or all of your initial capital.

Just like other margin trading, when you are on the wrong side of gold price movement, your initial margin will fall to a certain level that may trigger the margin call. In the event that you cannot fulfil the additional margin requirement, the dealer may liquidate your position. In that case, you do not only lose all your margin, but would also need to bear any loss to the account. The loss could far outweigh your paid margin.

14 February 2018