REIT FAQs

The following FAQs aim to provide investors with more information about REITs distributions and the general features of hotel REITs, being a specific type of REITs.

Distributions paid to unitholders by SFC-authorized Real Estate Investment Trusts (REITs) may be derived from rental income, a return of capital, and may be affected by various factors such as revaluation of properties and "step up" interest rate swap arrangements. Unitholders should pay attention to information about the components of the distributions from a particular REIT as disclosed in the offering circular, results announcements and financial reports.

- Are all distributions made by a REIT derived from the REIT's earnings?

No. Since a REIT is constituted as a trust, it is legally allowed to pay regular distributions whether or not it has profits. This means that in addition to distributing its earnings, a REIT may distribute part of its capital to investors, or borrow money to finance its distributions.

- How can I get more information on whether the distributions made by a REIT are out of profit, capital, or a combination of these?

At initial public offering- read the offering circular which usually sets out the amount of distributions per unit expected to be paid by a REIT in the forecast period. It also clearly discloses the amount of distributions that is expected to be paid out of capital and the amount that is to be derived from profit.

After listing - the annual and interim announcements/reports of the REIT should disclose to unitholders the components of the REIT's distributions, namely how much of the distributions are derived from profits and how much from return of capital.

- Is the amount of distributions directly correlated with the amount of profits generated by a REIT?

No. The Code on REITs provides that a REIT shall distribute not less than 90% of its audited annual income after tax in the form of distributions each year. However, the Code also allows a REIT manager to adjust the distributable income of a REIT to take into account of the effect of revaluation gains or losses. For example:

(a) the REIT manager may subtract revaluation gains on properties from audited income to arrive at the amounts available for distributions. Therefore, if the audited income after tax is largely attributed to the significant revaluation gains of properties, unitholders may not correspondingly enjoy high distribution payout.

(b) the REIT managers may retain the discretion or adopt a policy to add back revaluation losses to the amounts available for distributions. This means that unitholders may or may not be entitled to more distributions as a result of a reversal of the impact of revaluation losses.

- How does a "step-up" interest rate swap arrangement work?

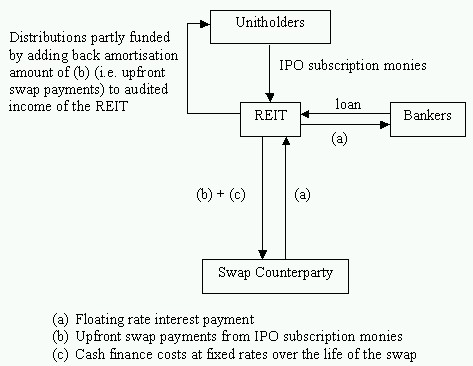

In order to hedge against the impact of changing interest rates on the interest burden of a REIT under a loan facility, a REIT may enter into a "step-up" interest rate swap arrangement with a swap counterparty. Under this arrangement, a REIT is usually required to make a substantial lump sum upfront payment to the swap counterparty funded by the IPO proceeds, which is in substance a prepayment of future interest expenses over the interest rate swap period. Over the life of the swap, the swap counterparty will provide the REIT amounts equivalent to the floating rate interest payments that the REIT has to pay the lenders under the loan facility. In return, the REIT will pay the swap counterparty interest payments at fixed rates which rise over the life of the swap.

Since the upfront swap payment is essentially a prepayment, it will be amortised over the life of the interest rate swap for accounting purposes. In other words, the income statement of the REIT will carry an amortisation charge of the upfront swap payment for each financial year during the interest rate swap period. However, pursuant to the trust deed of the REIT, such amortisation charge will be added back to the amount of distributable income as this amortisation does not involve any cash outlay from the REIT. Notwithstanding this adjustment, it should be borne in mind that the upfront swap payment is actually funded by the IPO proceeds, thus the adding back of amortisation charge of the upfront swap payment to distributable income effectively means that investors are funding part of the distributions they receive from the REIT by their own subscription monies.

Set out below is a typical "step-up" interest rate swap arrangement for illustration purposes:

The details of the arrangement depend on the length of the swap and the terms of the "step-up", investors shall carefully read the offering documents of REITs to understand the special features of the swap and the subject REIT before they invest.

- What are the benefits and costs of a "step-up" interest rate swap arrangement to the unitholders?

A "step-up" interest rate swap arrangement usually involves lower cash interest payments in the early years of the swap and higher cash interest payments in the later years, in order to match a potential increase in rental income.

The benefits are:

- it protects the REIT from the risk of increase in interest rates, and

- it enhances the yield to unitholders in the early years of the establishment of a REIT, due to the lower interest cost in the early years of the swap.

The costs and risks to unitholders are:

- upfront payments to the swap counterparty are funded by unitholders' own subscription monies, since part of the proceeds raised in the initial public offering (IPO) of the REIT is used to pay the upfront payment to the swap counterparty. As such, part of the distribution from the REIT during the life of the swap is effectively a return of capital, rather than out of operating profit of the REIT; and

- if there is a significant decline in rental income or a major economic downturn in the later years of the interest rate swap, distributions from the REIT may decline substantially due to higher finance costs as a result of the "step-up" structure. In a worst case scenario, there may not be any distributions from the REIT and the REIT's ability to service such finance costs may be adversely affected.

- What is distribution entitlement waiver? What is the benefit to me as a REIT unitholder?

The vendors of the properties sold to a REIT may sometimes subscribe for and retain some units in the REIT. In some cases, such vendors may also enter into distribution entitlement waiver arrangements under which they waive all or part of the distributions due to their units for a limited period of time. Such amounts waived will then be made available for distribution to other unitholders so that the distributions per unit to other unitholders will be enhanced.

Distribution entitlement waiver is another short-term measure for yield enhancement. Hence, the distributions and trading price of the REIT may be adversely affected when the waiver period ends. Further, if the income of a REIT declines over the distribution entitlement waiver period, distributions to unitholders may still fall notwithstanding the waiver arrangement.

- If there is a downward property revaluation, what are my risks in addition to decline in net asset value and market value of the REIT units?

A REIT has to comply with the relevant gearing ratio stipulated in the Code on REITs and certain financial covenants stipulated in a REIT's borrowing agreement. Both the gearing and financial covenants are referenced to the valuation of the properties from time to time. Therefore in the event of a downward property revaluation, a REIT may not be allowed to pay distributions to unitholders under the covenants of the loan documents.

- What is a hotel REIT?

A hotel REIT is a REIT that invests in a portfolio of hotel properties and generally leases the hotel properties to a lessee for a fixed term at predetermined rates under a lease agreement. As a result, the hotel REIT receives rental income from the lessee and is not involved in the running of a hotel business. The lessee will appoint a hotel manager to manage the day-to-day operation of the hotels under a hotel management agreement.

The salient features of the lease of a hotel REIT are:

- the lessee pays the hotel REIT a rent in return for the right to use and operate the hotel;

- the lease has a term that spans over a number of years which is generally longer than that of leases of office or retail properties;

- the lessee engages a hotel manager to operate the hotel;

- the rental payment generally comprises of two elements, namely a base rent (which is fixed and independent of the profitability of the hotel operations) and a variable rent (which is not fixed and linked to the profitability of the hotel operations); and

- a rental deposit of a few months of rental payment or a bank guarantee.

- What are the additional risk factors that an investor should consider before investing in a hotel REIT?

Cyclicality of hotel business:

- Whether the lessee can make rental payments depends on its ability to generate income from the operation of the hotel and other businesses (if any), and its financial standing.

- During a downturn in the hotel industry, poor operating results at the hotel may mean that the REIT will not receive any variable rent.

- In the worst case scenario, the lessee may default and not even pay the base rent.

Concentration risk:

- The hotel REIT is fully exposed to the profitability and credit standing of its lessee, the only tenant of the entire portfolio of hotel properties.

- If the lessee defaults, the amounts provided under the rental deposit or bank guarantee may not be sufficient to cover the rental payments due under the remaining term of the lease.

- If the lease is early terminated or expires

(a) the terms of the replacement lease may be less favourable;

(b) the hotel REIT manager may have to assume the operation of the hotel if it fails to secure a replacement lease.

Limitations in a future disposal of a hotel:

- Absence of a liquid market for hotel properties.

- The subsistence of long term hotel management agreements may have adverse impact on the marketability and pricing of a hotel when the REIT tries to dispose of the hotel in future.

- A hotel cannot be readily converted to alternative uses without incurring substantial costs.

- How does a hotel REIT with a lease structure differ from a listed hotel company?

Hotel REIT with a lease structure Listed Hotel company Assets held - Hotel properties

- Hotel properties

Business activity - Leases the hotel properties pursuant to a lease agreement

- Operate the hotel properties, including renting out the hotel rooms and retail space, and conducting food and beverage business

Source of income - Fixed rental income derived from the leasing of hotel properties

- Potentially variable rent linked to the financial performance of the actual hotel operations

- Income derived from the day-to-day operations of the hotel properties

Major income risk exposures - Seasonality and cyclicality in the hotel business, and external shocks to the hotel industry (such as epidemics) will adversely impact on the income stream of the hotel REIT if the lessee is unable to generate sufficient profits from the hotel operations or other sources to fund the rental payments to the hotel REIT

- Credit risk of the lessee

- Concentration risk as there is usually only one lessee leasing the entire portfolio of hotel properties from the hotel REIT

- Seasonality and cyclicality in the hotel business, and external shocks to the hotel industry (such as epidemics) will adversely impact on the income of the hotel company

Borrowings - May not exceed 50% of the gross asset value of the REIT

- Subject to the decision of the management or the board of the company

Dividend policy - Must distribute at least 90% of net income after tax, subject to adjustments for certain non-cash items

- Subject to the decision of the board of the company

- Aside from holding different types of properties, what are the major differences between a hotel REIT with a lease structure and a REIT that invests in retail or office properties ("retail/office REIT")?

Leasing of properties:

- a hotel REIT often leases the hotel properties to a single lessee or related companies.

- a retail/office REIT leases out its properties to a number of tenants under different lease agreements, incorporating different lease terms and expiry dates.

- the tenure of the lease agreement of a hotel REIT is generally longer than that of the lease agreements of a retail/office REIT reflecting the different market practices in these two segments of the property market.

Management of properties:

- the hotels of a hotel REIT are managed by a hotel manager engaged by the lessee pursuant to a hotel management agreement that generally lasts for 10 to 20 years. Therefore, if the lease agreement is early terminated by the REIT manager, the REIT may have to pay higher hotel management fees if the hotel management agreement subsists, or the REIT may have to pay cash compensation to the hotel manager if the REIT manager decides to terminate the hotel management agreement earlier than the scheduled expiry date.

- in the case of a retail/office REIT, the early termination of a lease agreement will not have any impact on the property management agreement signed between the REIT manager and the property manager.

Disposal of properties:

the flexibility in locating a buyer and the ability to fetch an attractive price may be more limited in the case of a hotel REIT, due to the longer tenure of the lease agreement and hotel management contract.