HK stock market

- Overview

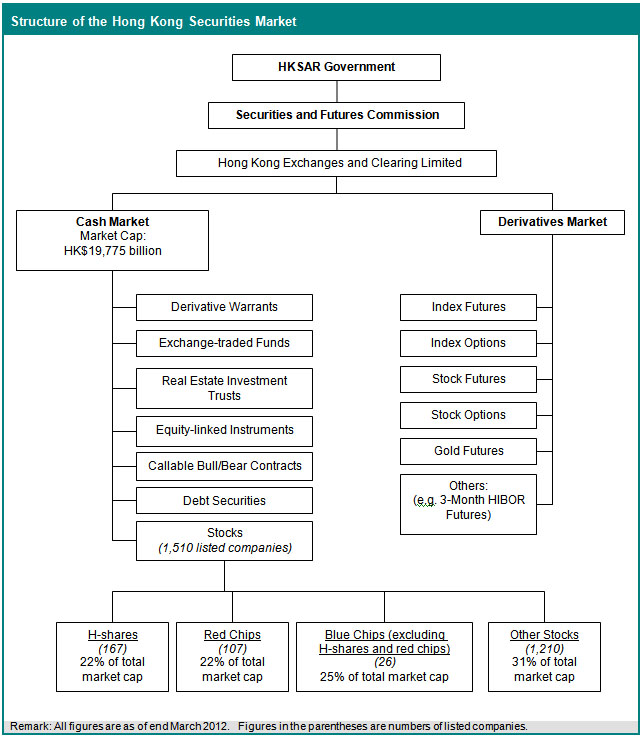

Hong Kong Exchanges and Clearing Limited (HKEx) is the market operator of the securities trading and clearing systems. It consists of a Main Board and the Growth Enterprise Market (GEM) board for stock trading. In addition to stocks, HKEx's cash market also provides the trading for derivative warrants, exchange-traded funds (ETFs), real estate investment trusts (REITs), equity-linked investments, callable bull/bear contracts (CBBCs) and debt securities. HKEx also operates a very active derivatives market, which includes the trading of index futures, stocks futures, index options and stock options. HKEx is regulated by the Securities and Futures Commission.

- Market size and composition

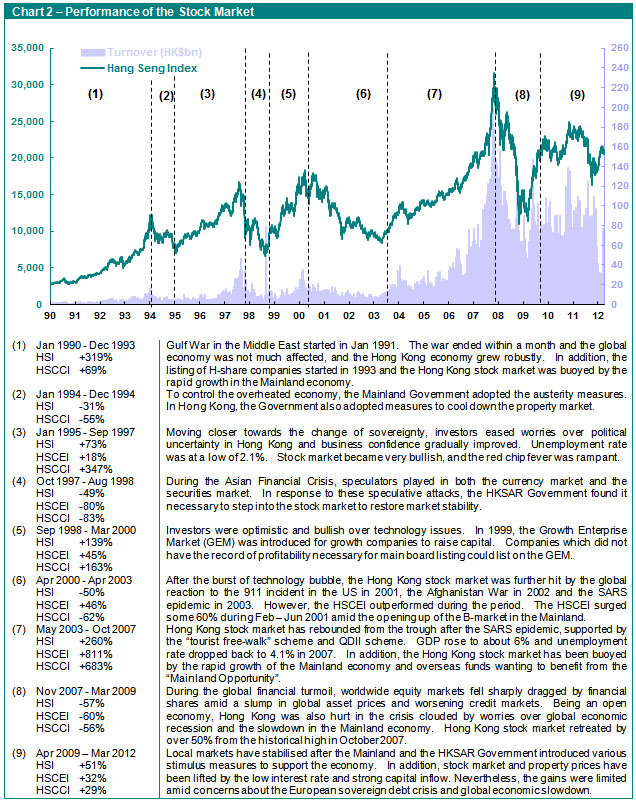

As of end March 2012, a total of 1,510 companies (1,337 on Main Board and 173 on Growth Enterprise Market) were listed on The Stock Exchange of Hong Kong (SEHK). Their market capitalisation reached $19,775 billion, the 6th largest in the world and 2nd in Asia (after Tokyo). The total market turnover was $16,303 billion in 12 months ended March 2012, or an average daily turnover of $67 billion.

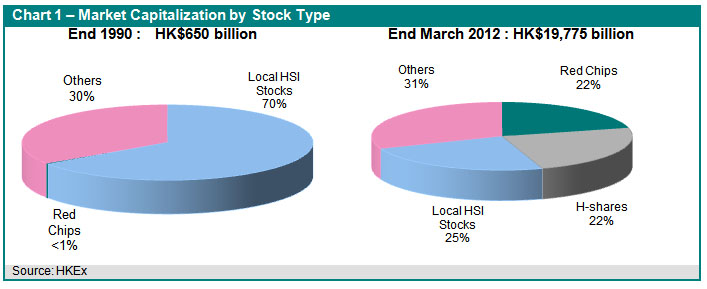

It is interesting to note that a significant part of the Hong Kong stock market is made up of Mainland companies. Mainland companies listed in Hong Kong consist of H-shares and red chips. In terms of market capitalization, Mainland companies accounted for 44% of the market total. In terms of turnover, Mainland companies accounted for 37% of the market total.

According to the definition of HKEx, H-share companies refer to companies incorporated in the PRC and approved by the China Securities Regulatory Commission for a listing in Hong Kong. The par value of the shares is denominated in RMB, and the shares are subscribed for and traded in HKD or other currencies. Red chip companies refer to the companies which are incorporated outside the PRC and controlled by Mainland entities.

Since the first H-share company listed in Hong Kong in July 1993, the H-share market has grown significantly. As of end March 2012, a total of 167 H-share companies were listed in Hong Kong, with a market capitalization of HK$4,446 billion, accounting for 22% of the total market capitalization. In terms of turnover, H-shares accounted for 27% of the total market turnover in 12 months ended March 2012.

The listing of red chip companies dates back to the 1980s. As of end March 2012, a total of 107 red chips were listed in Hong Kong, with a total market capitalization of HK$4,402 billion, accounting for 22% of the total market capitalization. In terms of turnover, red chips accounted for 10% of the total market turnover in 12 months ended March 2012.

Another important category of stocks is the "blue chips", normally defined as the constituents of the benchmark index - Hang Seng Index (HSI, see next section). Blue chips or HSI constituent stocks include some Mainland stocks. Excluding Mainland stocks, "local HSI" stocks currently account for about 25% of the total market capitalization. In terms of turnover, they accounted for 14% of the total market turnover in 12 months ended March 2012.

Trading of other stocks and investment products accounts for the remaining 49% of the total market turnover. Of this, trading of derivative warrants and CBBCs has grown rapidly in recent years and accounts for 26% of the total market turnover in 12 months ended March 2012.

- Benchmark indices

The Hang Seng Index (HSI) is the benchmark index commonly adopted for tracking the performance of the Hong Kong stock market. It has a history of over 35 years and is one of the earliest stock market indices in Hong Kong. The HSI is widely used as the base index for various derivative products. In 1986, the HSI futures contract was launched. Since then, it has become the most actively traded derivative product in Hong Kong. Thereafter, the HSI options contract was introduced in 1993. The Mini-HSI futures and options contracts, which are one-fifth the size of the standard contracts, were launched in 2000 and 2002 respectively to serve the trading and hedging needs of retail investors. These contracts provide investors with a set of effective instruments to manage investment risk and may also affect the performance of the stock market, to some extent, due to cross-market transactions between the cash and the derivatives markets.

In 1999, the Tracker Fund, the first exchange-traded fund adopting the HSI as its base index, was listed on the SEHK. Today, there are more than 540 index-linked products (most are derivative warrants) based on the HSI. As of end March 2012, a total of 48 stocks are selected as the HSI constituents, including local stocks, red chips and H-shares.

The Hang Seng China Enterprises Index (HSCEI) was launched in August 1994 to track the performance of Hong Kong listed H-share companies after the listing of the first H-share company in 1993. As of end March 2012, the HSCEI comprises 40 H-shares.

The Hang Seng China-Affiliated Corporations Index (HSCCI) was launched in 1997 to track the performance of the red-chip companies. As of end March 2012, the HSCCI comprises 25 red chips.

- Highly externally-oriented market

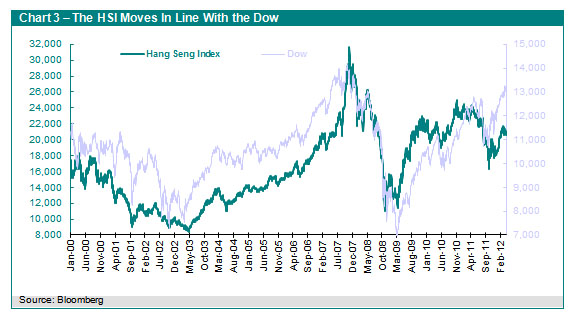

It is very important to note that apart from its own economic fundamentals, market performance in Hong Kong is subject to the influence of the rest of the world. See also chart 3 below. In general, the performance of the Hong Kong stock market moves in line with major overseas markets. In addition, some key features of the Hong Kong market are worth mentioning.

- Free flow of capital and linked exchange rate regime

In Hong Kong, there is no capital control. Free flow of capital is highly valued, as enshrined in Article 112 of the Basic Law. In other words, capital flow into and out of Hong Kong is completely free and without limits. There is no restriction of any kind. Similarly, in the stock market, capital can move into and out of it freely. Capital movements in periods of turmoil, particularly from overseas investors, can be massive, swift and volatile and the Hong Kong stock market is therefore subject to that risk.

Since 1983, the HKD has been linked to the USD at a rate of 7.8. Because of the Linked Exchange Rate regime, the interest rate in Hong Kong should closely follow that in the US, regardless of the underlying economic performance in Hong Kong. In other words, interest rate movements, whilst it may have some impact on the performance of the stock market, are very much determined by factors outside Hong Kong.

- Highly externally-oriented economy and listed companies

A commonly adopted indicator to measure the openness of an economy is the trade-to-GDP ratio. The ratio shows the size of external trade in the current account (i.e. exports and imports of goods and services) relative to the size of an economy. A high trade-to-GDP ratio indicates that the economy is open, and vice versa. The ratio for Hong Kong was about 370% in 2011, which was one of the highest in the world. This indicates that Hong Kong economy is highly externally-oriented and therefore subject to the influence of the economic performance of the rest of the world.

Listed companies in Hong Kong are also highly externally-oriented, as many of their significant sources of earnings originate from overseas jurisdictions. As of end March 2012, there were 274 H-share and red chip companies listed in Hong Kong. Altogether, they accounted for about 44% of the total market capitalization. These companies are essentially Mainland companies, with their sources of earnings originating in the Mainland. The performance of these companies therefore follows the economic performance of the Mainland, rather than that of Hong Kong. Even for non-Mainland companies, it is quite common for major sources of earnings to come from outside Hong Kong. HSBC and Hutchison Whampoa, which are among the largest non-Mainland companies listed in Hong Kong, accounting for 10% of the total market capitalization, had about 75% of their earnings coming from overseas markets. Many listed companies in Hong Kong are highly externally-oriented and subject to the influence of the economic performance of other parts of the world.

- Significant participation by overseas and institutional investors

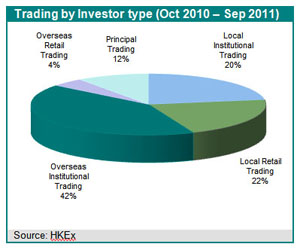

According to a survey conducted by HKEx, overseas investors and institutional investors (these categories are not mutually exclusive) account for a large proportion of trading on the Hong Kong market. Overseas investors accounted for 46% of the total trading for the 12 months ending September 2011, whilst institutional investors constituted about 62% of the total. It is worth noting that overseas and institutional investors are relatively more sophisticated in terms of trading strategies, knowledge in the market and the scope of their investment.

According to a survey conducted by HKEx, overseas investors and institutional investors (these categories are not mutually exclusive) account for a large proportion of trading on the Hong Kong market. Overseas investors accounted for 46% of the total trading for the 12 months ending September 2011, whilst institutional investors constituted about 62% of the total. It is worth noting that overseas and institutional investors are relatively more sophisticated in terms of trading strategies, knowledge in the market and the scope of their investment. - Market regulation and investor protection

The Securities and Futures Commission (SFC) is an independent non-governmental statutory regulator of the Hong Kong securities and futures markets.

The SFC has six statutory regulatory objectives for the securities and futures industry in Hong Kong:

- to maintain and promote the fairness, efficiency, competitiveness, transparency and orderliness of the industry;

- to promote understanding by the public of the operation of functioning of the industry;

- to provide protection for the investing public;

- to minimise crime and misconduct in the industry;

- to reduce systemic risks in the industry; and

- to assist the Financial Secretary in maintaining the financial stability of Hong Kong by taking appropriate steps in relation to the industry.

In carrying out its regulatory responsibilities, the SFC adopts a philosophy of considering the interest of investors first and providing adequate, but not absolute, protection to investors. While the SFC tries to ensure that the behaviour of market participants follows prescribed regulations, investors are expected to accept responsibility for their own investment decisions and for assessing the level of risk which they are able to accept.

The SFC acts as the gatekeeper by operating a licensing regime. Intermediaries such as brokers and investment advisers must first meet qualifications requirements before dealing in securities or giving investment advice to clients. They must then conduct their business in compliance with ongoing conduct and financial position requirements.

Listed companies in Hong Kong are regulated under a disclosure-based regime that is essentially "caveat emptor or buyers beware" approach. Relevant information is made available to investors under this disclosure regime but it is up to the investors to ensure that they utilise this appropriately. For listing on the SEHK, companies must first meet basic financial, track records and corporate governance requirements and disclose sufficient information in a prospectus for investors to make informed investment decisions. After listing, they must meet ongoing obligations including timely disclosure of financial reports, price-sensitive information and discloseable transactions. The SEHK is the frontline regulator of listing activities. The SFC oversees the SEHK and also regulates takeovers and mergers, reviews company announcements and listing applications filed to both the SFC and SEHK under the Dual Filing regime. The SFC also conducts activities to detect and investigate insider dealing and market manipulation, as well as enforcing disclosure of interests of substantial shareholders, directors and chief executives of listed companies.

The SFC closely monitors the securities and futures markets and co-ordinates market contingency planning to reduce systematic risks and seeks to ensure that the markets operate orderly under all circumstances, especially during crisis situations.

Effective regulation needs to be backed by credible enforcement. The SFC closely monitors activities of the markets and intermediaries to combat misconduct and crimes that jeopardise the interests of investors. It will take firm regulatory action including disciplinary or legal proceedings, against parties who breach regulations.

The SFC also keeps close contact with overseas and Mainland regulators to combat international financial crime and misconduct. Whilst the SFC's regulatory power generally stops at the borders of Hong Kong, it may share intelligence information with and provide assistance to overseas and Mainland regulators concerning enforcement matters, or request information and assistance from them. It may also refer complaints falling within the competence of other jurisdictions to the relevant overseas regulators.

While the SFC rigorously pursues those who defraud investors, it has no legal powers to make an order for compensation. However, in cases of broker default only, a separate Investor Compensation Fund (ICF)exists to compensate retail investors for their loses, regardless of their nationality. This is based on a per-investor compensation limit of HK$150,000 for trading securities and futures contracts respectively. The ICF generally covers only securities and futures contracts traded respectively on the SEHK and The Hong Kong Futures Exchange. It does not cover losses due to drops in share prices or corporate failure of listed companies (e.g. liquidation).

No regulation can eliminate all regulatory breaches nor the risk of broker default or failure, and the regulatory Hong Kong environment is designed to minimise but not eliminate their occurance.

In every market, well-informed and financially literate investors are the first line of defence against fraud and malpractice. The SFC therefore complement regulation, by conducting a variety of activities to advise investors of both their rights and responsibilities as well as educate them to understand market risks, make informed choices and safeguard their own interests.

1 Unless otherwise specified, currencies are denominated in Hong Kong dollars.