Your retirement plan

When you start thinking about retirement, what sort of lifestyle do you want? Do you look forward to one free of work, without worrying about having enough money to pursue your dreams? Is this really a Mission Impossible? It's not, with proper planning...

Remember that action speaks louder than words and empty thoughts. Once your retirement goals are set, it's time to act. No matter what your retirement goals are, you should begin planning as early as possible.

The first step is to work out how much you will need to meet your retirement goals. Your MPF (Mandatory Provident Fund), personal savings and investments all go towards building your retirement nest egg.

Retirement may last for years or even decades - after all, everyone wishes for good health and longevity. If you have not saved enough, you may have to postpone retirement or settle for a less desirable lifestyle.

Risks to your retirement plan that must not be underestimated

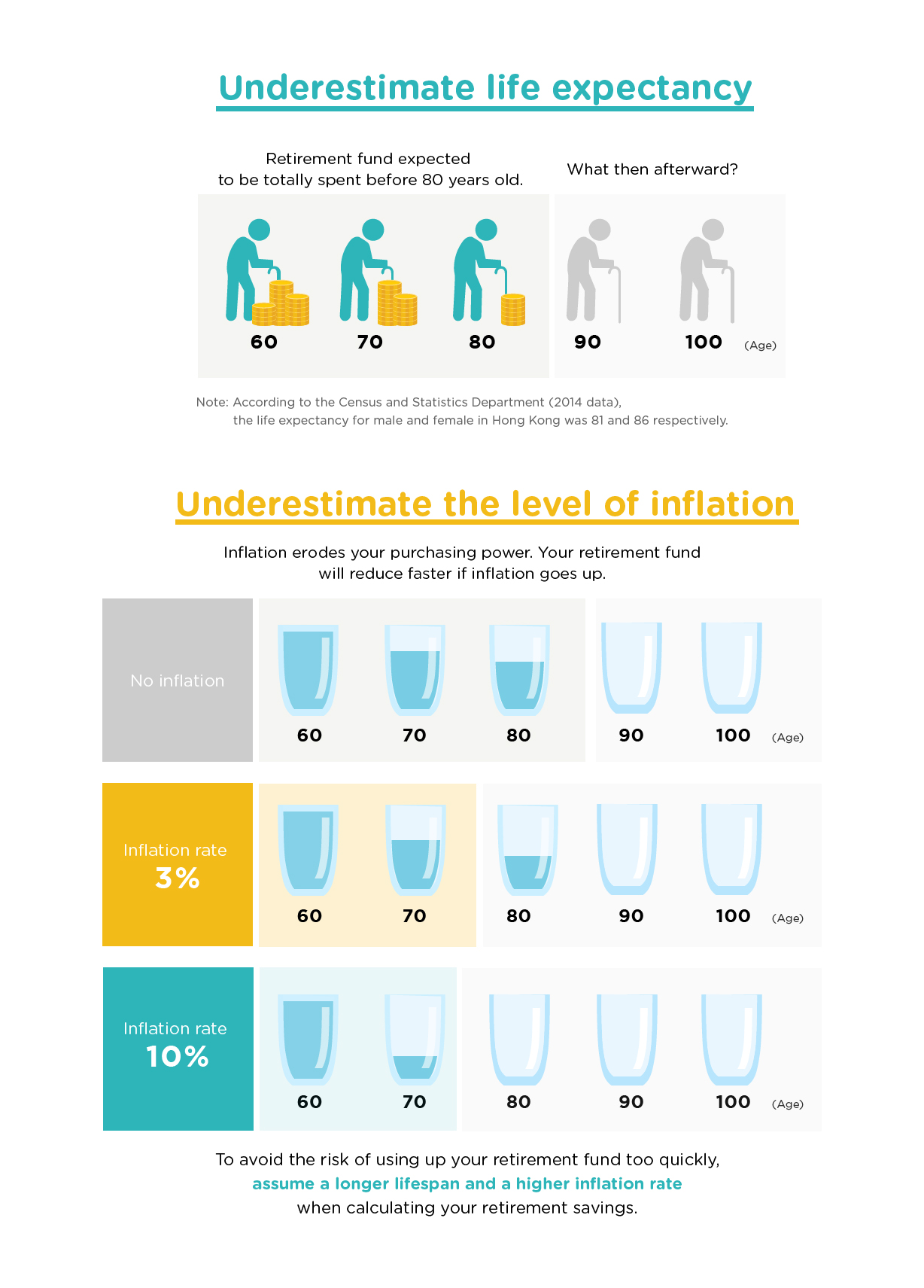

Like any investment product, retirement planning involves risks. First, you can never be sure of your life expectancy. Secondly, you may underestimate the level of inflation. If you underestimate these two factors, chances are you will use up your nest egg faster than you think!

Tips for developing your retirement plan

- Start planning your retirement as early as possible.

- Take into account the two factors mentioned above regarding lifespan and inflation when determining the funds required for retirement.

- Use our Retirement Planner to work out how much you will need to retire and the funds you can expect to save after factoring in your MPF and personal assets.