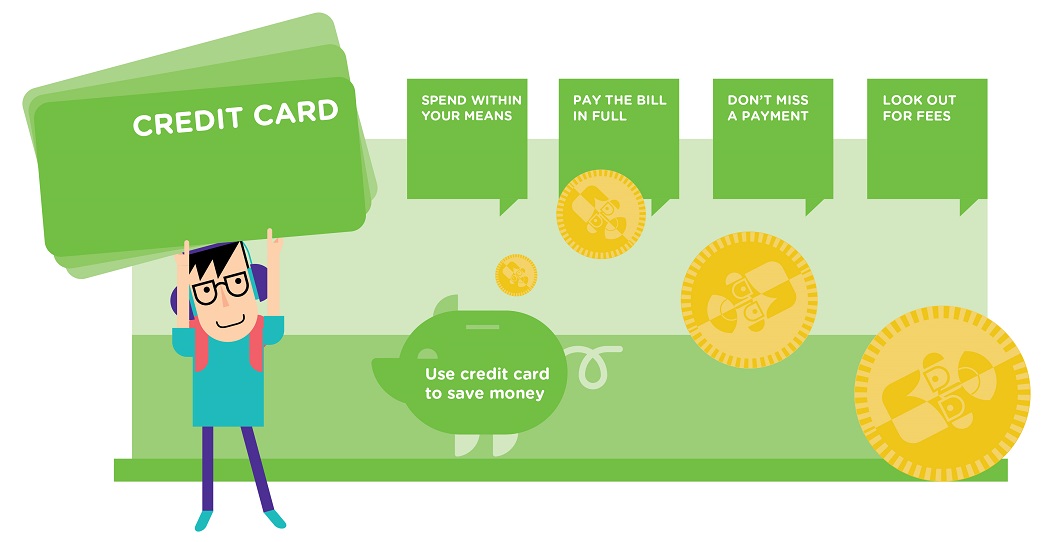

Top five credit card tips

Credit cards are convenient and useful when shopping, buying things online and even for building a good credit history. But it's also tempting to spend money you haven't earned, or buy something you can't really afford. Here are the top five tips to use your credit cards wisely:

1. Spend within your means

Use credit cards responsibly and consider your actual needs before shopping with your credit cards. Use our Budget Planner to create your monthly budget and stick to it to avoid over-spending.

2. Pay the bill in full

The annualised interest rate for overdue credit card balance is very high (usually more than 30%). So make sure you settle the balance in full every month to avoid paying high interest. If you cannot settle in full, pay as much as you can afford and settle the remaining balance as soon as possible. Never just pay the minimum amount.

3. Don't miss a payment

When the statement arrives, pay it straight away so you don't forget about it. If you don't pay on time, there will be a late-payment charge and your credit rating may be affected. Make use of the autopay service or set a calendar reminder for credit card payment every month to avoid late payment charges.

4. Look out for fees and charges

Understand the various types of fees, e.g. annual fee, charges for foreign currency transactions, late payment charges etc. Be aware that such fees and charges vary among banks. Check with your bank every year to see if you can get your annual fee waived.

5. Use your credit card as a savings tool

If you pay off your bill in full every month, it would be a good idea to save money by using your credit cards to cover your daily expenses, so that you can earn cashback, bonus, air miles and also enjoy discounts.