Hong Kong couples suffer financial hangovers after expensive wedding days, says Investor Education Centre survey

Weddings are largely funded by personal savings and monetary support from parents

11 December 2016

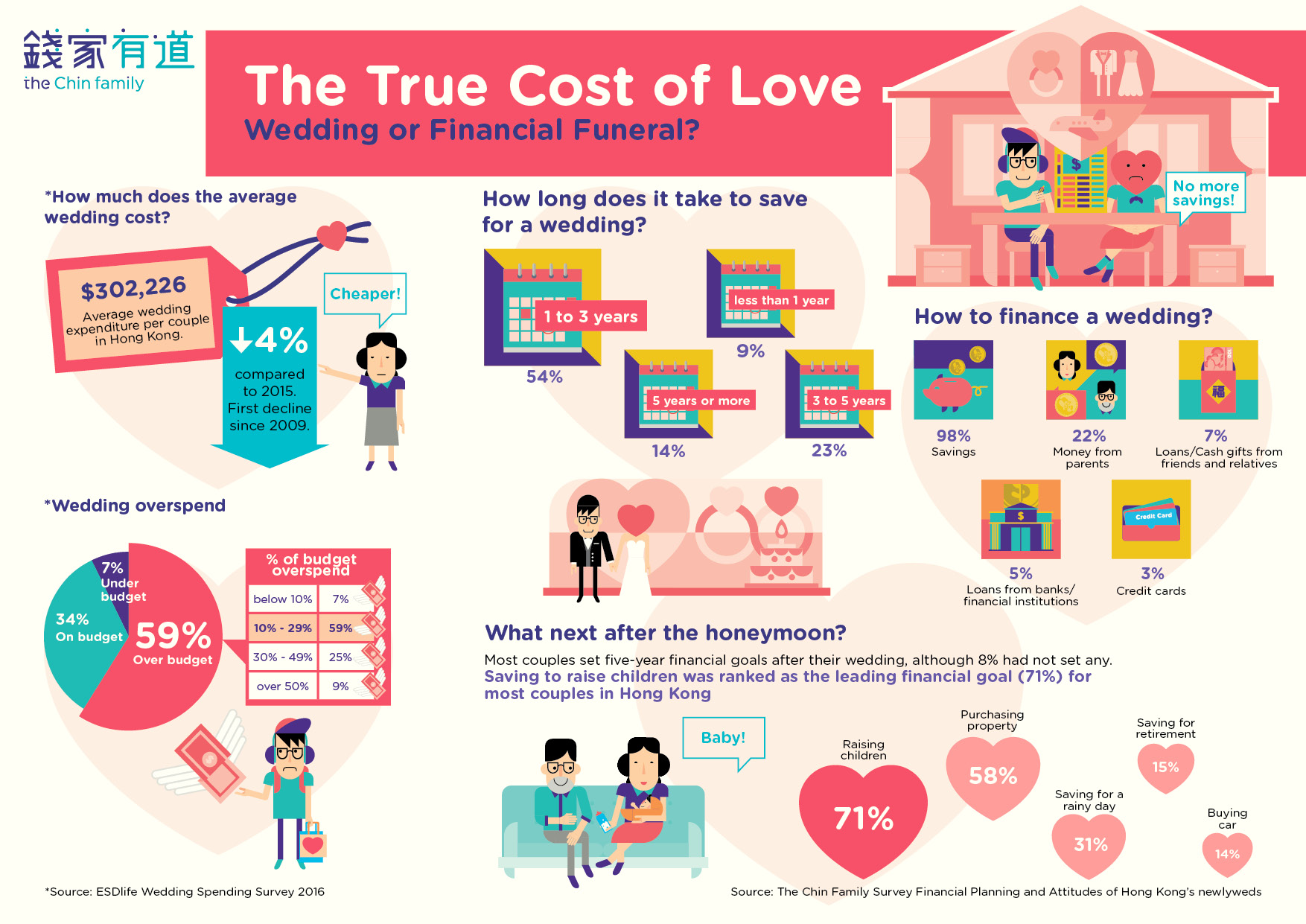

- Hong Kong couples suffer financial hangovers after expensive wedding days, 60% of surveyed couples overspent on their weddings;

- To finance their wedding, 22% depended on parental support; 5% and 3% said they would take out wedding loans from banks or financial institutions and use credit lines respectively

- The top two financial goals in the next five years are saving to raise children (71%) and buying property (58%). Yet nearly 70% of respondents have no plans to save for a rainy day.

According to the Investor Education Centre (IEC), a significant number of couples in Hong Kong failed to budget thoroughly for their wedding, while almost 60% overspent on their big day. The findings also revealed that around 22% of respondents would depend on parental support to finance their wedding, while some couples said they would take out a wedding loan.

IEC commissioned ESDlife to conduct an online survey titled "Financial Planning and Attitudes of Hong Kong's Newlyweds". A total of 1,245 newlyweds were interviewed from August to October 2016.

Financing the Big Day

According to data from ESDlife’s Wedding Spending Survey 2016, Hong Kong couples spent an average of HKD302,226 on their weddings, indicating a drop of 4% in comparison to the previous year. Even though couples were more cautious than before in their spending, almost 60% still went over budget. One third (34%) of the couples interviewed said they managed to stay on budget by controlling expenditure, with 7% successfully managing to come in under budget. For those who overspent (59%), nearly six in ten said they were over budget by 10% to 29%, whilst a quarter (25%) overspent by 30% to 49%, and 9% overspent by 50% or more.

IEC further revealed that almost all couples (98%) said they would use their own or their partner's savings to finance their wedding. However, parents still play a role in financing the big day, with 22% of respondents indicating they would receive financial assistance from their parents. Few said they would take out a wedding loan to cover costs (5% would take a loan from a bank or financial institution; 3% would use credit), and a further 7% said they would also need to depend on loans or cash gifts from friends and relatives to help repay the bills.

On the average, about half (54%) of the couples surveyed spent one to less than three years saving up for their wedding, with close to a quarter (23%) taking three to less than five years to save up. 14% said they needed five years or more to save a sufficient amount.

Mr David Kneebone, General Manager of the IEC, said, "When it comes to weddings, couples naturally want to create unforgettable memories and hence may be tempted to splurge or are reluctant to compromise to keep within budget. However, making smart decisions and necessary trade-offs can help prevent newlyweds from having to start their marriage burdened with debt."

After the honeymoon, what comes next?

The survey also revealed that most couples set five-year financial goals after their wedding, although 8% had not set any. Saving to raise children ranked as the leading financial goal (71%) for most respondents, while purchasing property came in second (58%), followed by saving for a rainy day (31%). Saving for retirement (15%), buying a car (14%), saving for your own or a spouse’s advanced education (13%), and buying insurance to protect the family (13%), were also among the most commonly cited financial goals for couples in Hong Kong.

Mr Kneebone also added, "Often couples place so much attention on the wedding day that they fail to undertake long term financial planning when starting out this new chapter in their lives. We encourage couples to communicate with each other about household finances including their savings plan, and agree on clear financial goals in order to build a good foundation for their future together."