Shares holding

In Hong Kong, investors have two ways of holding shares - in paper share certificates or in an electronic form within the CCASS (Central Clearing and Settlement System). Either way has its own features which investors should be aware of.

Paper and electronic form

Shares held in paper form are registered in the company's Register of Members under the investor's own name or in the name of a chosen nominee. The registered owner has the legal right of owning the shares, and all corporate announcements and entitlements are delivered to the owner directly. However, paper securities may cause inconvenience as they require physical safe-keeping which can be lost or stolen, and must be deposited back into the CCASS before the securities can be sold on the Stock Exchange of Hong Kong, which may take up to 10 days.

On the other hand, investors who hold shares in an electronic form under the CCASS enjoy the convenience of trading and safe-keeping, as the shares are deposited either in their Investor Participant Account directly opened with the CCASS, or with their broker and/or bank (where their securities accounts are opened) which is a CCASS Participant. Learn more about how to open a CCASS Investor Participant Account.

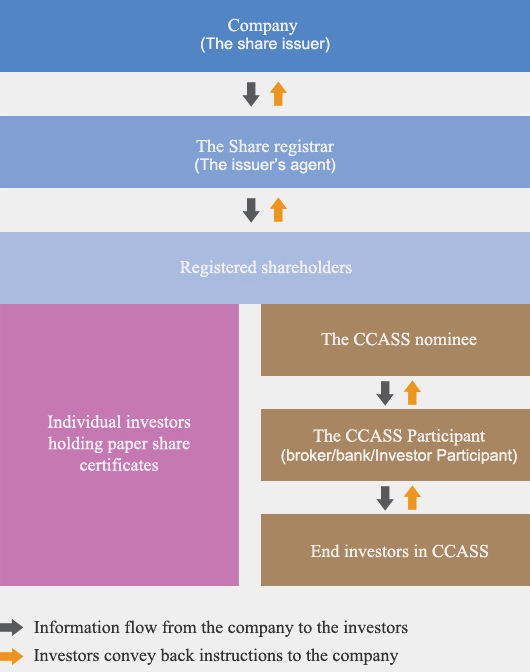

As the shares deposited into the CCASS will be registered under the name of CCASS nominee (ie HKSCC Nominees Limited), in other words, the investors don't actually have the legal right of the shares, while they remain to be the beneficial owners. It's worth noting that all corporate communications and entitlements will therefore be delivered to the CCASS nominee which will then pass on to the beneficial owners through the relevant brokers and banks.

Investors should make their own discretion in choosing whether to hold shares in paper share certificates. When subscribing new shares of an IPO (initial public offering), investors can choose the channel for subscription to suit their own needs. Investors should use white form or White Form eIPO if they want to receive paper share certificates issued in their own names. Otherwise, they should use yellow form or CCASS eIPO (Electronic Subscription). Learn more about subscribing new shares.

Flow of corporate communications

Depending on which form you hold the shares, there are differences in the way you are informed of corporate actions, corporate communications, procedures to attend and vote in general meetings or shareholder meetings held by the listed companies.

-

Corporate actions

Corporate actions refer to events that may have material changes to the company and affect its shareholders. Examples are rights issue, open offer, merger and acquisition, share consolidation or sub-division, dividends in cash or stocks, etc. Shareholders may be invited to vote on some of these events. Corporate announcements will be issued in respect of these events and annual or special general meetings.

If you hold shares in paper form, you will receive the information of the listed company's corporate events directly. If you hold shares in an electronic form within the CCASS, you will need to liaise with your bank or broker to receive such information.

When a corporate event invites shareholders to vote for or against a decision, the relevant announcement will be issued to the registered shareholders (ie those who hold shares in paper form or the CCASS nominee). If you hold shares in paper form, you can send back your instructions to the company directly. If you hold shares in the CCASS, your broker or bank will deliver the announcement to you and you need to convey the instructions back to CCASS through your bank or broker. In the latter case, you should be aware that the time window for conveying the instructions back to the company may be shorter as both the broker/bank and the CCASS need some time to consolidate the instructions.

-

Corporate communications

Likewise, if you hold shares in the CCASS and wish to receive corporate communications directly, you should inform your broker and/or bank who will then pass your name and address to the share registrar. The share registrar will mail the relevant corporate communications to you directly. But you are still required to vote through your broker or bank in relation to the corporate event. If you are an Investor Participant, you may relay your request for receiving corporate communications directly to the CCASS nominee.

-

Attend and vote in general/shareholder meetings

If you hold shares in the CCASS and want to exercise your shareholder's right by attending and voting at shareholders' meetings, you should contact your broker/bank to make the necessary arrangements. If you are an Investor Participant, you may relay your request for receiving corporate communications directly to the CCASS nominee.

Remember, unlike investors who hold paper share certificates, your name is not shown on the companies' Register of Members and you will not be allowed to attend the meeting without the above-mentioned prior arrangement. Alternatively, you can nominate a person as your representative to attend the meeting and cast the vote for you. A common way is to send your voting instructions to your broker/bank which shall pass the instructions to the CCASS nominee. The CCASS nominee will then appoint a proxy to attend the meeting and vote according to your instructions.