Listing by introduction

Key Messages:

- Listing by introduction is a way of listing shares already in issue on another exchange. No marketing arrangement is required as the shares for which listing is sought are already widely held.

- The listing approval procedures for a new listing by introduction are the same as those for initial public offerings (IPO).

- Before investing, you should read the listing prospectus and visit the HKExnews website to check for any updates relating to the company being listed by introduction.

This article aims to help you know more about what listing by introduction is, how a company gets listed on the Stock Exchange of Hong Kong (SEHK) by introduction, and what information to look for before buying shares of a company to be listed by introduction.

What is listing by Introduction?

Listing by introduction is one of the means by which a company can list its shares on the SEHK. An introduction is an application for listing of shares already in issue where no marketing arrangements are required. This is because the existing shares for which listing is sought are already of such an amount and so widely held that there would be an open market for the trading in these shares.

Since only existing shares are listed by introduction, it follows that no new shares will be issued and no additional funds will be raised.

Comparison between IPOs and Listings by Introduction:

| IPO | Listing by introduction | |

| Raise new funds | ✓ | X |

|---|---|---|

| Issue new shares | ✓ | X |

| Listing of shares already in issuance | X | ✓ |

A listing by introduction is commonly in circumstances where:

- the shares of the company concerned have already been listed on another exchange; or

- the shares are being migrated from one exchange to another.

Listing approval process

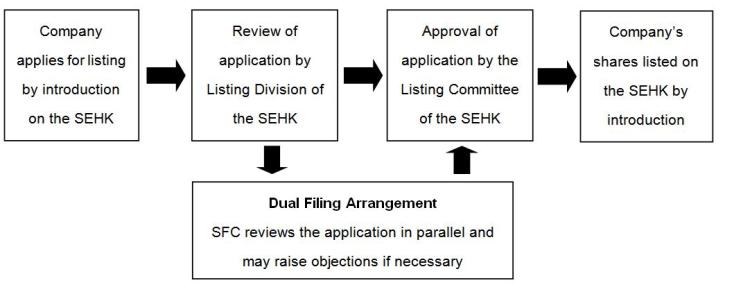

The procedures for vetting and approving a new listing by introduction are identical to those for IPOs. The Listing Division of the SEHK is responsible for reviewing listing materials and administering the listing process under the Listing Rules. When the Listing Division is satisfied that the applicant complies with all new listing requirements, it recommends the Listing Committee to approve the application. The Listing Committee is a panel made up of a suitable balance of individuals with different background, including those from the securities industry.

Under the dual filing regime, the Securities and Futures Commission also reviews a listing application in parallel with the SEHK and may exercise its statutory power to object to a listing application.

Pre-listing arrangement

For a company whose shares have already been listed on another stock exchange, if its shares are to be listed on the SEHK by introduction, they must be transferred first from the share register of the market where they are listed (usually overseas) to the Hong Kong share register. Only share certificates issued by the Hong Kong shares registrar will be valid for delivery for share trading done on the SEHK.

Once the transfer and registration processes are completed and the company is listed on the SEHK, investors can trade the company's shares through their brokerages, similar to trading of other listed shares.

However, since it will take longer for shares to transfer between the local and overseas registers, the SEHK will consider whether sufficient shares are available for trading to ensure an open market and orderly trading at the time of listing.

Pointers for investors

When deciding whether to invest in stocks listed on the exchange by introduction, you should take a similar approach as if you are investing in IPO shares. Read the listing document or prospectus of the company to understand its business nature, its performance, its outlook, to find out any corporate action being taken recently (e.g. a stock split, dividend distribution, or an acquisition) and any possible risk factors. Besides obtaining the listing document from the sponsors, you can visit the HKExnews website to retrieve the information online and check for any updates related to the company from time to time.

Stay smart as an investor and ask first. In case of drastic changes in share prices, look up the factors behind the price movements instead of trading on rumours.