Listed Structured Products - Derivative Warrants, Inline Warrants and CBBCs

Derivative warrants (known as “Warrants”), inline warrants and Callable Bull/Bear

Contracts (CBBCs) ...

/sites/web/common/images/investment/investment-products/warrants-and-cbbcs/warrants-landing.jpg

youtube

Portal-Investment

Features-InvestmentPortal

22/01/2021

Listed Structured Products

Derivative Warrants, Inline Warrants and CBBCs

Derivative warrants (known as “Warrants”), inline warrants and Callable Bull/Bear Contracts (CBBCs) are all listed structured products in the Hong Kong Exchanges and Clearing Limited (HKEX).

Structured products are derivatives products that have the following characteristics:

- Structured products are linked to specific asset(s) (or underlying asset(s)) which can be a stock, an index, a fixed income, a currency, a commodity or a basket of assets. The performance of structured products heavily rely on that of the underlying asset(s).

- While the terms vary from one structured products contract to another, investors may feel overwhelmed when choosing warrants, inline warrants or CBBCs as there could be over 100 warrants, inline warrants or CBBCs linked to a particular popular stock in the market at any given time.

- Leverage effect takes place when the cost of buying structured products is lower than that of the underlying assets. Although leverage may generate greater returns, it also comes with higher risks.

- The structure, operation and pricing of structured products are very complicated and investing in which involves high risks, making them unsuitable to inexperienced investors and those with lower risk tolerance, such as retirees.

Warrants

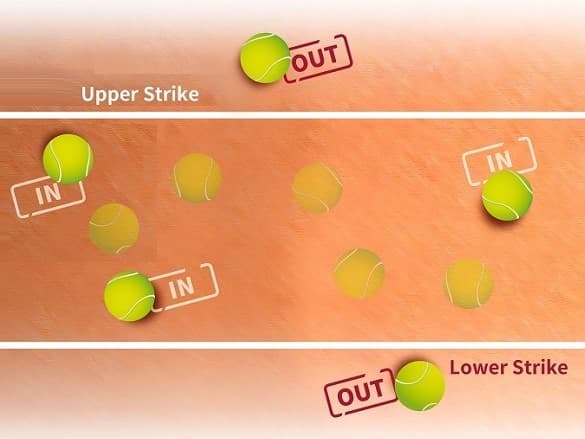

Inline warrants

CBBCs

More about listed structured products

22 January 2021