An introduction to inline warrants

When it comes to buying warrants, there is now an alternative to call and put warrants in the HKEX. It is inline warrants, which is designed for a relatively stable market environment in general.

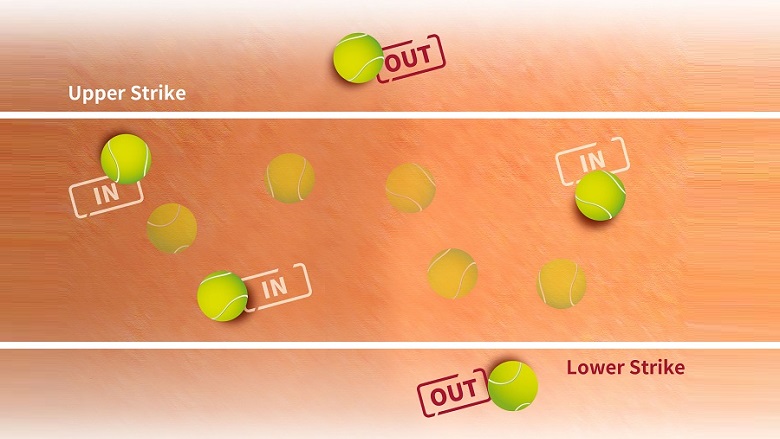

The operation of inline warrants is likened to that of a ball game. There is an “in and out of bounds” rule for almost all the ball games such as soccer, basketball and tennis. This is also the rule for inline warrant trading. An inline warrant is structured with a pair of upper and lower strikes, which form a corridor within which the price of the underlying asset* must remain at expiry. If the price of the underlying asset falls above the upper strike or below the lower strike at expiry, it will become out of bound.

In general, investors will buy a call warrant (a put warrant) in anticipation of the upward (downward) movement of the price of the underlying asset. When buying an inline warrant, investors will rather have the underlying asset exhibiting less price volatility. Unlike call and put warrants, the payoff from inline warrants is fixed and pre-determined. If the underlying asset price falls within or at the lower or upper strike at expiry, i.e. in-the-range, the payoff per inline warrant will be $1. If the underlying asset price falls above the upper strike or below the lower strike at expiry, i.e. out-of-the-range, the payoff per inline warrant will be $0.25.

Risks of Inline Warrants

- The payoff of an inline warrant depends on whether it is in-the-range or out-of-the-range at expiry. If the underlying asset price of an in-the-range inline warrant exhibits volatile or unidirectional movement (i.e. keep moving upwards or downwards), it will have higher risk of falling out-of-the-range.

- As the payoff of inline warrants at expiry is fixed, the maximum profit and loss at the time of investment can be anticipated. If the inline warrant is in-the-range at expiry, the maximum profit will be $1 multiplied by the number of inline warrants purchased less the investment amount and transaction cost. In contrast, when the inline warrant is out-of-the-range at expiry, the maximum loss will be the investment amount and transaction cost less $0.25 multiplied by the number of inline warrants purchased. In the event of insolvency or default, the maximum loss will be the entire investment amount plus transaction cost.

While inline warrants can be bought and sold at any time before maturity, the payoff of inline warrants at expiry exhibits the binary characteristic, i.e. there are only two possible outcomes of either offering $1 (in-the-range) or $0.25 (out-of-the-range). As such, this can be regarded as an “all or something” investment.

Inline warrants are subject to those risks similar to other structured products such as liquidity risk. Investors who are interested in trading inline warrants should read the risk factors carefully in the launch announcement and supplemental listing document.

*Note: At launch, the underlying assets are limited to Hang Seng Index and the top five most liquid stocks listed on the Exchange in terms of turnover.

2 August 2019