Product disclosure

There are a number of regulatory measures to enhance the transparency of the sales process of Investment-Linked Assurance Schemes (ILAS) products. To make the best use of product disclosure, you should carefully look at the important information disclosed in ILAS Product Key Facts Statement (KFS) and Important Facts Statement (IFS), and be clear that the assumed rates of returns shown in the illustration document do not guarantee future returns nor represent any past performance.

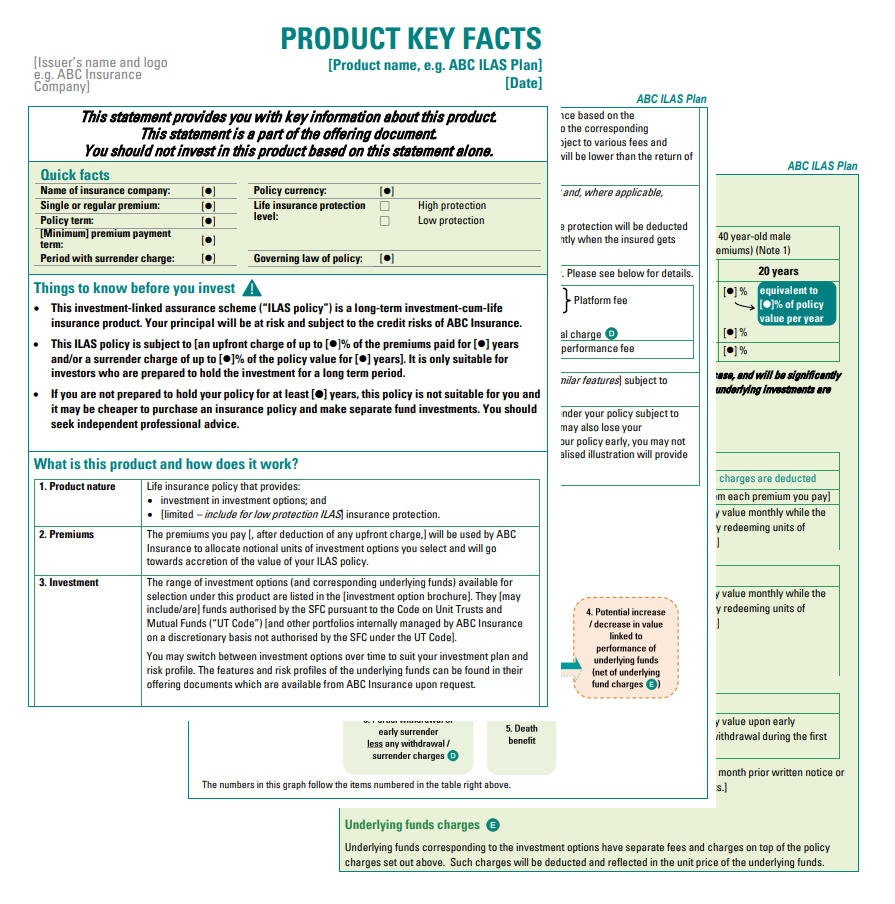

- Product Key Facts Statements (KFS)

To find out all relevant information about an ILAS, read its offering documents including the Product KFS.

Product KFS summarises the key facts, features and risks of the ILAS in easy-to-understand language to help the public better understand the product, including the basic information of the ILAS product, long term investment-cum-life insurance feature, key risks, fees and charges with total policy charges illustration, and the remuneration of sales intermediaries. Please refer to the ILAS section of the “How to Read Product Key Facts Statements” booklet for details.

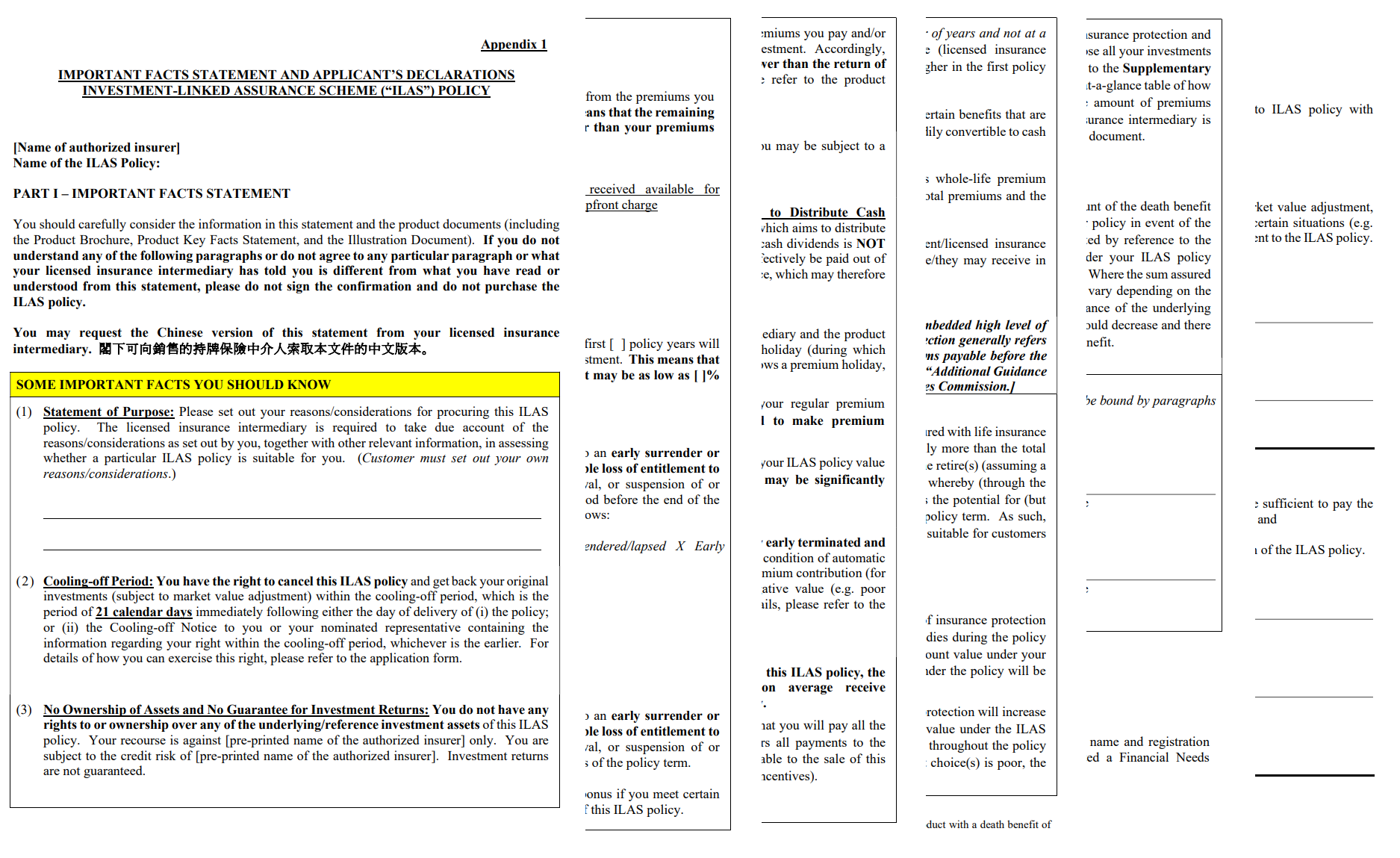

- Important Facts Statement (IFS)

At the point of sale, you will be asked to confirm your reasons of buying the ILAS product in the "Statement of purpose" section in the IFS (click here to learn about the sales process). The IFS highlights the important facts of the ILAS product to increase your awareness of these facts such as the long-term nature of ILAS policies, fees and charges, early termination penalties, intermediary remuneration and cooling-off period.

For ILAS products with an embedded high level of insurance protection, the IFS also contains additional information in relation to the high protection features including the long-term nature, cost of insurance protection and the sum assured under the ILAS policy.

These matters will be explained by the intermediary during the sales process before the customer signs the IFS / Applicant’s Declarations.

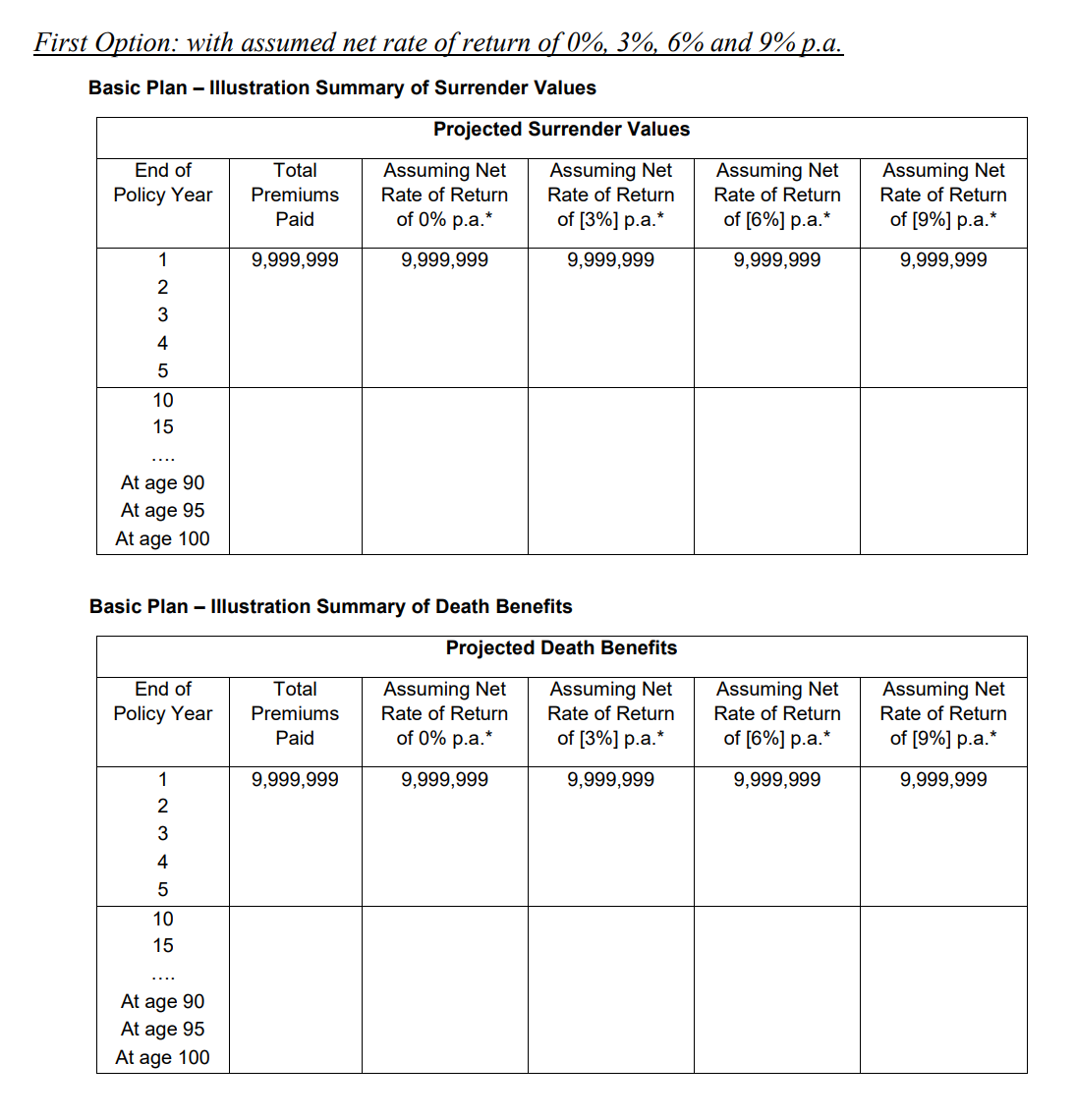

- Illustration document

Intermediaries selling the ILAS must explain the illustration provided to you as a potential ILAS buyer.

The insurance company must prepare a personalised illustration document for you to review and sign before you complete the application for an ILAS. The document typically shows you the amount that you would expect to receive upon surrender of the ILAS policy and projected death benefits based on certain assumed rates of returns after deduction of all relevant fees and charges at policy level as disclosed. The figures do not guarantee future returns (unless the policy offers a return guarantee) nor represent any past performance.

The purpose of the illustration document is not to project or forecast returns available under the ILAS policy but to demonstrate the impact of fees and charges on the amount that the investor may receive based on certain assumed rates of return. The assumed rates of returns are for illustrative purpose only. Don't confuse the assumed rates (i.e. hypothetical) with the actual rate of return of an ILAS. The actual return may be different.

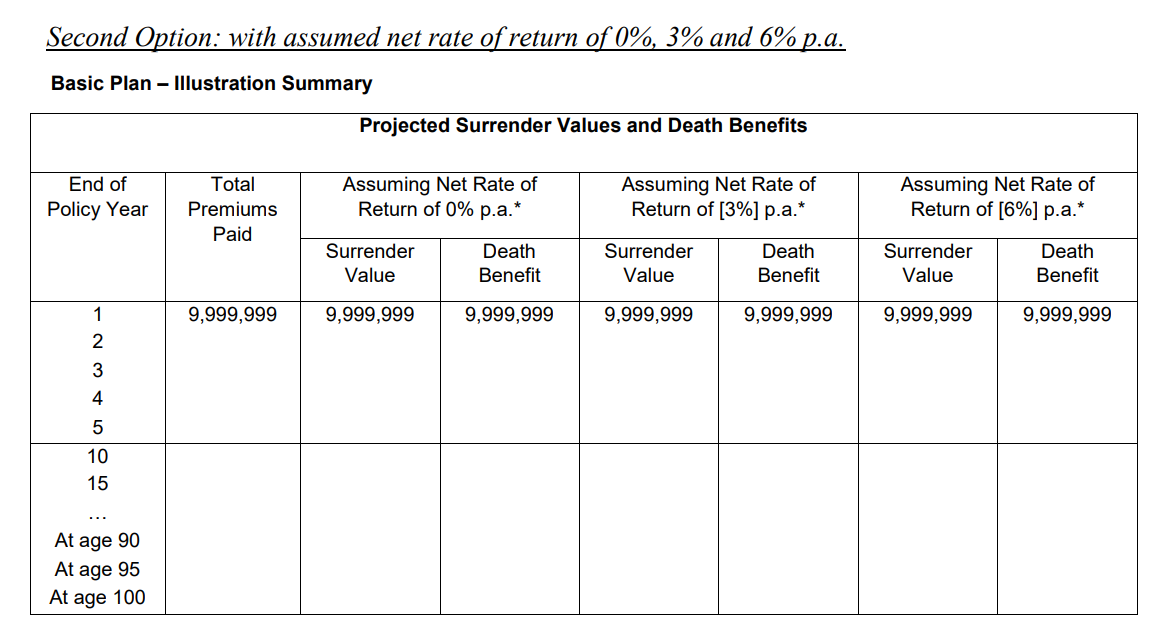

Illustration shall be made using one of the following options:

- Four assumed net rates of return (i.e. 0%, 3%, 6% and 9% per annum) with separate tables showing the corresponding surrender value and death benefit respectively; or

- Three assumed net rates of return (i.e. 0%, 3% and 6% per annum) with the same table showing the corresponding surrender value and death benefit.

The assumed rates of return are requirements imposed by the Insurance Authority on insurance companies and are applicable to all ILAS policies.

Don't sign under the declaration unless you fully understand the information in the illustration document, and have received the principal brochure.

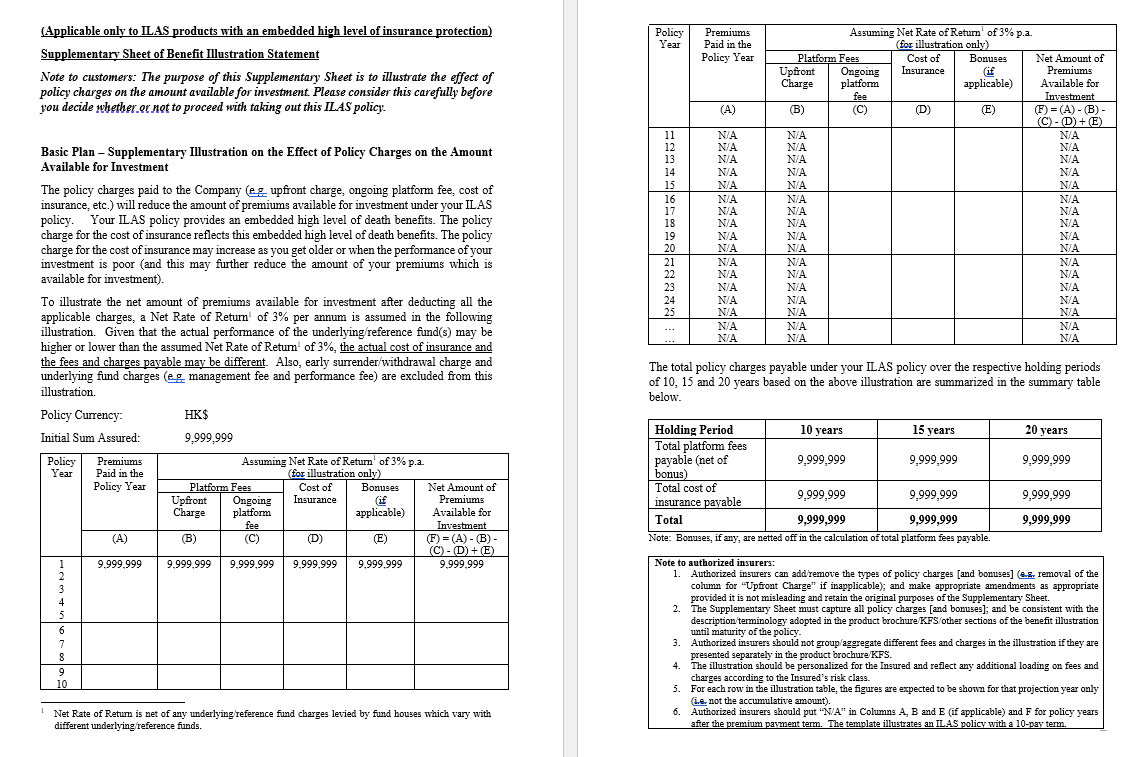

- Supplementary Sheet of Benefit Illustration Statement (Applicable only to ILAS products with an embedded high level of insurance protection)

The purpose of the Supplementary Sheet of Benefit Illustration Statement is to illustrate the effect of policy charges on the amount available for investment for ILAS products with an embedded high level of insurance protection. The policy charges paid to the insurance company (e.g. upfront charge, ongoing platform fee, cost of insurance protection, etc.) will reduce the amount of premiums available for investment under an ILAS policy. The policy charge for the cost of insurance protection will reflect the embedded high level of death benefits of the ILAS policy. The policy charge for the cost of insurance protection may increase as you get older or when the performance of your investment is poor (and this may further reduce the amount of your premiums which is available for investment).

To illustrate the net amount of premiums available for investment after deducting all the applicable charges, a net rate of return of 3% per annum is assumed in the illustration. Given that the actual performance of the underlying/reference fund(s) may be higher or lower than the assumed net rate of return of 3%, the actual cost of insurance and the fees and charges payable may be different. Also, early surrender/withdrawal charge and underlying fund charges (e.g. management fee and performance fee) are excluded from the illustration.

Supplementary Sheet of Benefit Illustration Statement: