Funded swap

Key Messages:

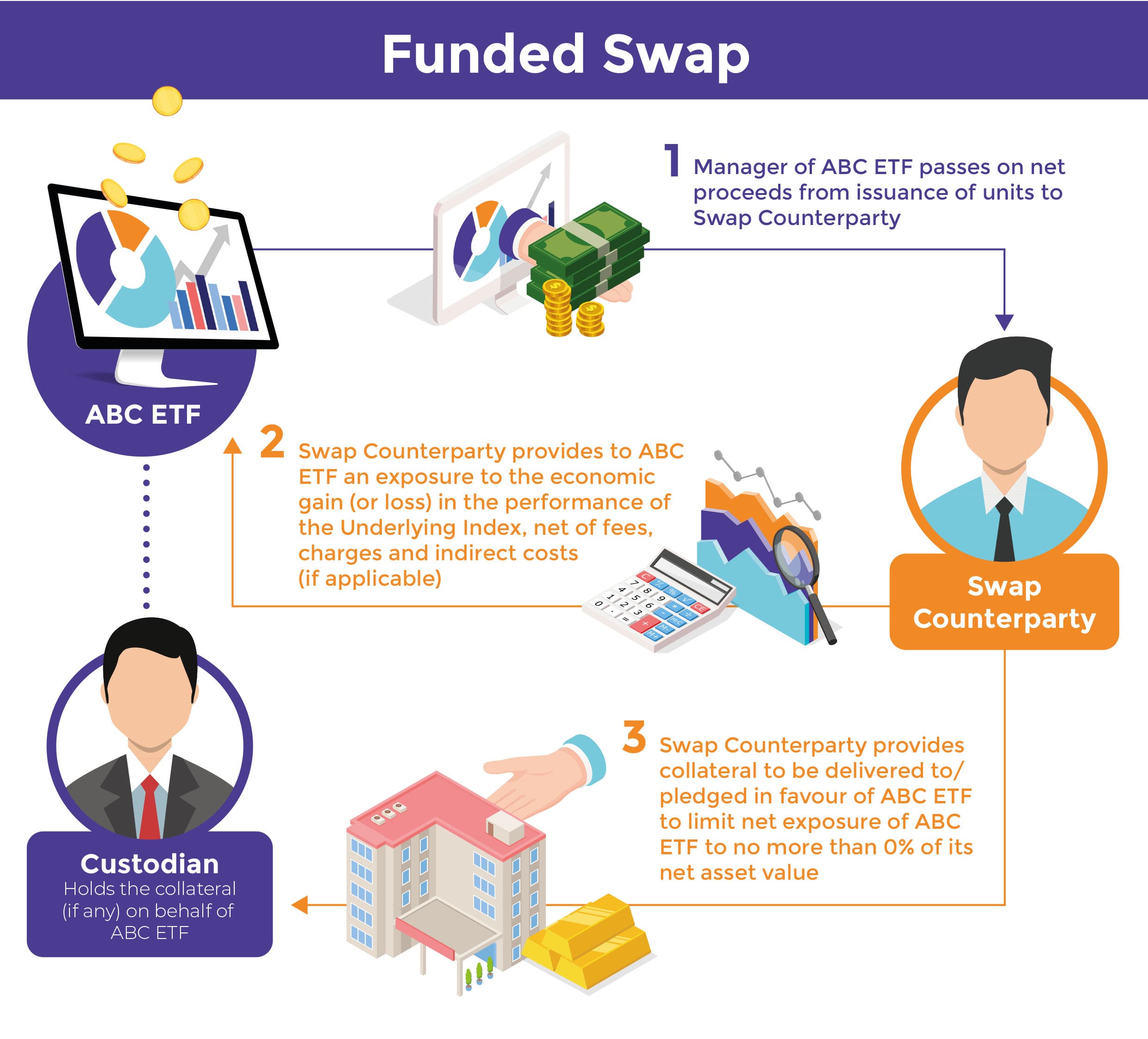

- Under a funded swap, a synthetic passive ETF passes on net proceeds from issue of units to a swap counterparty in return for an exposure to the economic gain (or loss) in the performance of the underlying index.

Whether synthetic passive ETF managers disclose information on collateral or invested assets depends on the types of investments they are involved in with their counterparties. This section explains some common types of investments entered into by synthetic passive ETF managers with their counterparties in order to replicate the index performance.

Under a funded swap, as illustrated in the diagram below, the synthetic passive ETF, through the funded swap, will pass on substantially all of the net proceeds generated from the issuance of the fund to the swap counterparty, who in return, through the funded swap, will provide the synthetic passive ETF with an exposure to the economic gain (or loss) in the performances of the underlying indices (net of fees, charges and indirect costs, if applicable).

The synthetic passive ETF manager will manage the fund with the objective to reduce to nil its single counterparty net exposure. In other words, the net value of the collateral, marked to market at the end of each trading day, shall be no less than 100% of the net asset value of the fund. Where the fund’s gross exposure to a counterparty exceeds 0% at the end of each trading day, the counterparty will generally have to provide collateral to be delivered to/ pledged in favour of the fund to limit net exposure of the fund to that counterparty to no more than 0% of its net asset value.

Therefore, if a synthetic passive ETF invests in a funded swap when adopting a synthetic replication investment strategy, the fund manager will be required to disclose the components of the collateral and their top 10 holdings in the collateral on their websites. Such information will have to be updated on a weekly basis.

19 May 2020