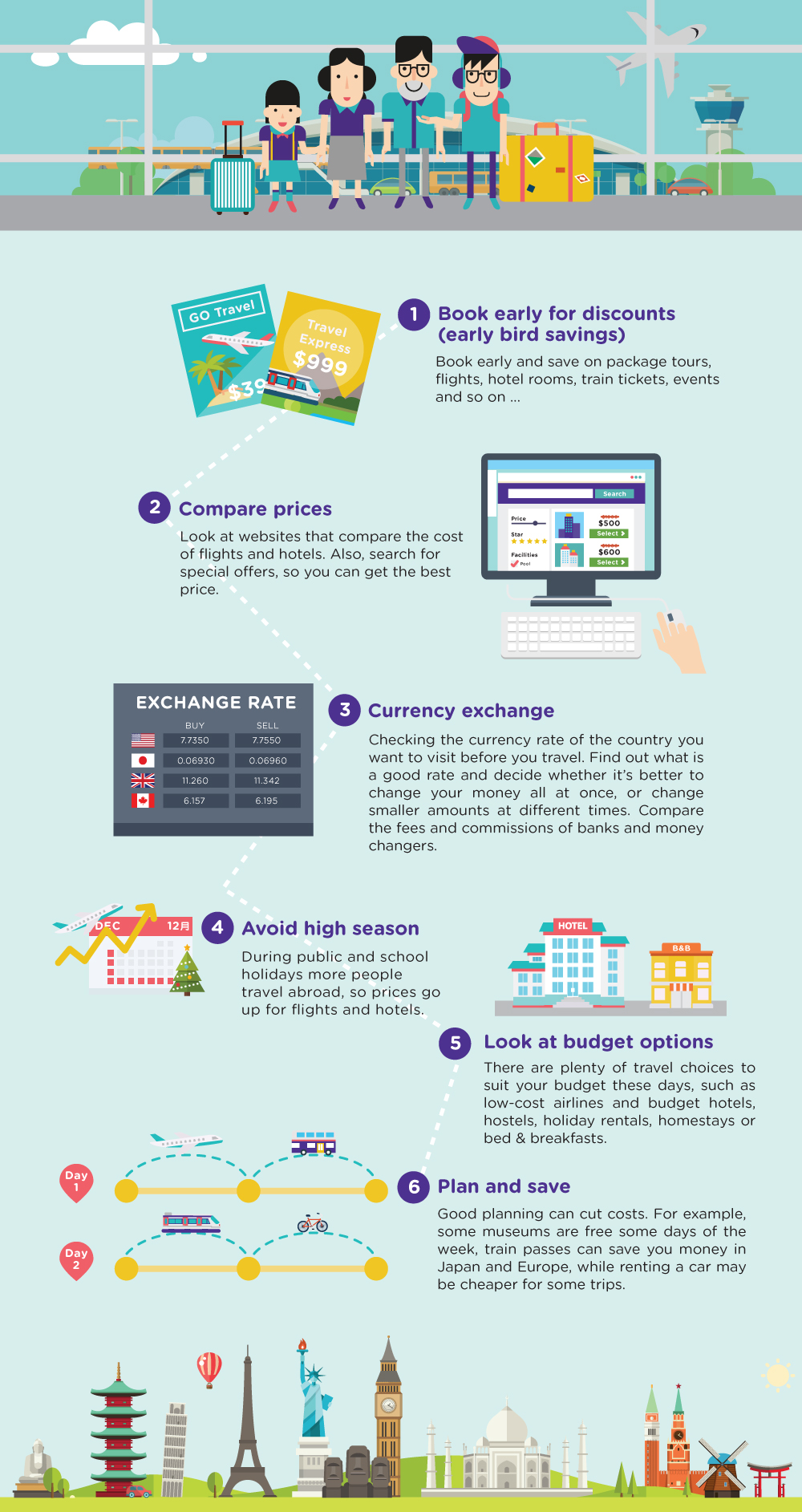

Make your travel dollar go further

Whether you choose to travel independently, or on a package tour, as a backpacker or on a luxury cruise, you want value for money. Before you set off, plan ahead to make the most of your holiday money.

Make smart choices

Take time to research your travel plans and choose the best option, so you can enjoy the same or better service for less.

More travel tips

Buying travel insurance

Travel insurance premiums depend on coverage and the amount insured. It takes into account how long you travel, how expensive medical care is where you go, whether you will take part in risky activities and so on.

Taking out cash

You can withdraw foreign currency as you travel with your ATM card or credit card. You must first tell your bank to activate the card, and then find an ATM that works with cards such as China UnionPay, Visa, MasterCard. Find out how the exchange rate is determined and what the charges are before taking out cash. Don’t use your credit card for foreign currency cash advances, as this can be costly.

Using your credit card overseas

If you make overseas purchase with credit card in foreign currency, you usually won’t know the exchange rate until you get your credit card statement. You may be able to pay in Hong Kong dollars at the current exchange rate when you pay by credit card overseas. But usually a charge of about 1.5% to 4% (a percentage of the exchange rate) will be added. Fees will also be charged by the bank, or card association.

Staying connected

Pocket WIFI, roaming SIM cards or eSIM are among the most popular ways to go online while travelling. The prices of these option vary depending on the duration, amount and data speed required. eSIMs may seem to be the most convenient as it does not require a physical SIM card. However, they are only compatible with newer mobile phone models. So do shop around to determine which one is the most suitable option for you.