Money matters in life and death

Everyone has an estate, no matter how large or how small. This comprises of everything that you own, from your savings, investments, life insurance, home, car, furniture and personal possessions. Whilst death is inevitable, you may unexpectedly find yourself in a situation where you are mentally no longer able to manage your own money matters, for example if diagnosed with dementia, or suffering from a serious illness. However, you can make early arrangements to entrust someone dependable to handle your money matters according to your instructions. Having a proper plan in place to protect you and your family will give you better peace of mind when death or incapacity strikes.

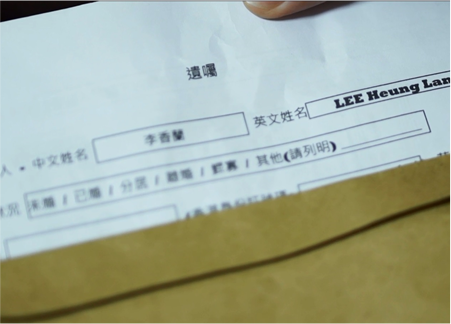

Your final will

Have you given thought about what to do with your estate and how your after-death arrangements should be managed? If you already have a preference, present your ideas clearly in the form of a will, so that your final instructions can be carried out. Even if you do not care much or do not have a preference, it is best that you share your thoughts (no preference is also a preference indeed) with your family and friends to help them handle your after-death affairs.

Having a will can avoid the potential disputes associated with probate that can be costly when it ends up in court.

Mental incapacity

Dementia is a common condition amongst the elderly. Dementia patients gradually become mentally incapable of taking care of themselves and need to be cared by others. Losing mental capacity may cause some financial issues, for examples your caretaker fails to use your property or someone abuses your property. Making prior arrangements becomes necessary to avoid these financial issues, and could help you receive the appropriate care after you fall ill.

It is better not to simply assume that your relatives will take care of your financial matters when you become mentally incapacitated. Without prior arrangements, your relatives may not help even they want to.