Reverse mortgages: Using your home to help pay for your retirement

Property is often a good investment in Hong Kong, where land is in short supply. When you retire, you can make money from your property by selling it or renting it out. If you want to continue living in your property, though, this will not be an option. There is, however, another way of getting money from your property while you still live there. It's called a reverse mortgage.

How can a reverse mortgage help pay for your retirement?

The Hong Kong Mortgage Corporation Limited (HKMC) has a Reverse Mortgage Programme, under which banks offer loans that are secured against your properties.

This programme lets you use your property to pay for your retirement. You can use your home as security to borrow from a bank. You can opt to receive monthly payouts over a fixed term or throughout your entire life which is steady income for your retirement. Unlike most loans secured against property, repayment is not an issue for borrowers in a reverse mortgage. If you take out a reverse mortgage, you can live in your home for the rest of your life without paying any money back. If you want your children or your loved ones to inherit the property after you have gone, you can discuss with your inheritors in mind about the repayment arrangement (see below).

Here's how a reverse mortgage plan* works:

| Entry age: | To apply, you must be 55 or older (aged 60 or above for owners of subsidised sale flats with unpaid land premium). |

|---|---|

| Loan: | You may choose to receive monthly payouts over a fixed time or throughout your entire life. Or, you can take out the loan in one lump sum. |

| Repayment: | No repayment will be required during your lifetime, except you wish and choose to do so. |

| Occupancy: | You may stay at your property for the rest of your life. |

| Repayment arrangement: | After you have passed away, your inheritors can keep your property if they repay what's left of the loan. If they choose not to, the bank will sell the property to recover any outstanding debt. Any shortfall will be covered by the HKMC, because you would have paid the mortgage insurance premium when you joined the programme. |

*You need to understand the terms of the programme before signing up for it.

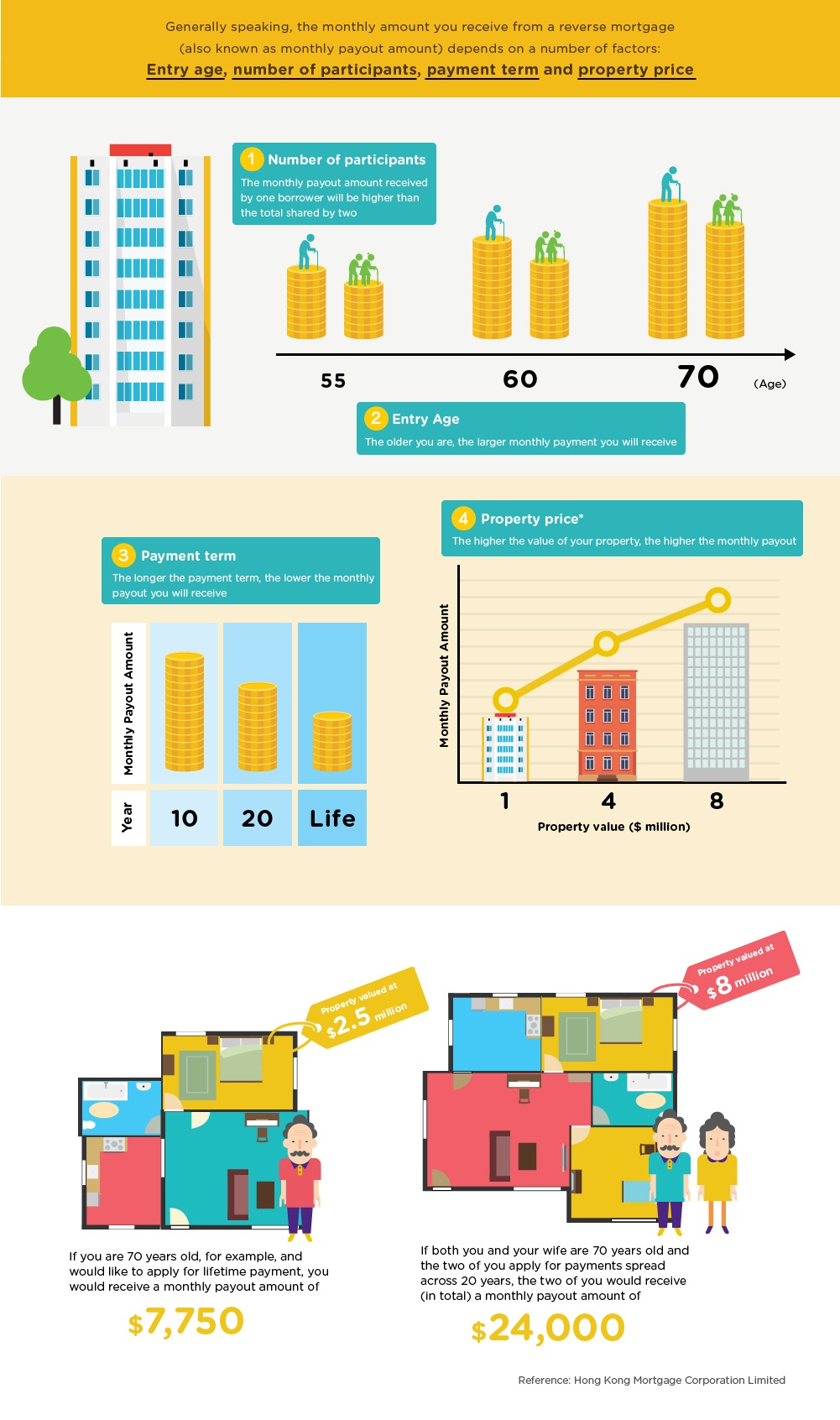

How big a reverse mortgage loan can you get?

Note:

- Depending on your financial needs, you can choose not to take the maximum amount of loan.

- The above details are provided as examples only. If you wish to know more about the actual monthly payout amount you may receive under the Hong Kong Mortgage Corporation Limited's Reverse Mortgage Programme, please contact one of the participating banks.

If you are interested in the Reverse Mortgage Programme:

- Pay attention to the costs and expenses of joining the programme, such as interest payments, administration fees, mortgage insurance premiums, counselling fees, etc.

- Understand your financial needs and how this arrangement may affect your estate planning.

- Understand the terms and requirements of the Programme.