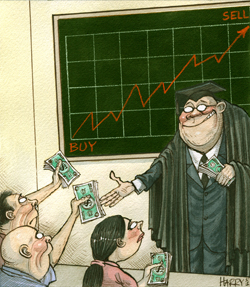

Beware of classrooms turned dealing rooms

In today's volatile financial markets, the promise of making a quick buck is no doubt tempting. A number of entities have been quick to catch on to this mentality by offering to "teach" investors how to make the most of the markets. In advertisements appearing in the local media, they try to get people to enroll in so-called "sure-win" investment training programmes, for a tuition fee. Typical curricula are as follows:

- Techniques to accurately predict market trends

- Strategy to make substantial profit quickly through a small outlay

Paying to attend securities analysis courses is becoming popular among retail investors, who have become much keener to improve their investment knowledge after the financial crisis.

However, attendees at such courses should take extra care lest they get involved in a situation that resembles a dealing room more than a classroom. As it is, some "instructors" may have strayed beyond their educational remit into offering investment advice - without a licence.

Clear line between learning and dealing

A licence is not required from a financial regulator for simply running a training institution or sharing general investment knowledge. Also, the law does not impose any ceiling (or floor) on how much someone should pay to equip themselves with investment knowledge.

But if during class, the instructor digresses from imparting general investment knowledge to recommending specific stocks that you should buy, be really cautious. Be even more alert if your instructor offers to deal on your behalf.

But if during class, the instructor digresses from imparting general investment knowledge to recommending specific stocks that you should buy, be really cautious. Be even more alert if your instructor offers to deal on your behalf.

Care must be taken to draw a clear line between learning and dealing with unlicensed intermediaries. Simulated investing using a notional portfolio may be a useful way to learn, but trading real shares based on someone's recommendations is beyond the gamut of the classroom.

Unlicensed activities

Courses lasting just a few hours or a couple of days may cost more than $10,000. While no statistic is available as to how many attendees got what they were after, quite a number of them have been disappointed with some having complained to the SFC about being misled. They were further disappointed to find out that neither the training centres nor the instructors were licensed to give investment advice or to deal in securities.

Companies and individuals seeking to advise on or execute trading of securities, futures and non-bank retail leveraged foreign exchange on behalf of members of the Hong Kong public are required to be licensed by the SFC. Doing so without a licence can result in a fine and even jail time for individuals.

Not long ago, one instructor of a "training centre" was convicted of publishing adverts promoting a futures investment advisory business and carrying on regulated activities without an SFC licence.

When seeking advice on securities trading, approach an SFC licensee. Beware of free seminars in securities trading followed by pricey courses promising quick profits.

To get an SFC licence, an individual must meet certain competency requirements in terms of industry and management experience, pass specified examinations and keep up to date by undertaking a required amount of continuous professional training so that he/she can fulfill the role required and discharge due responsibility. He or she must be accredited to a licensed corporation while such a corporation must meet prescribed financial resources criteria and comply with a number of other regulatory requirements in order to be and remain licensed.

Due diligence is key

To avoid paying for unlicensed investment advice, check the Public Register of Licensed Persons and Registered Institutions in the SFC site to verify the status of the "educational institute" or "instructor." The register tells you the types of SFC-regulated activity they are permitted to carry on. In addition, look up other relevant information, such as whether the licence is still valid and whether the licensee has had any disciplinary record or came under a different company name before.

Unlicensed persons sometimes dispense their investment advice on line. But no adviser can be absolutely spot on with his/her so-called "investment tips" over a period of time, whether he or she does it on line or off line, with or without a licence. Investing is all about doing homework - understand your financial needs and whether the products meet your objectives. Above all, know the risks before making an investment decision.