Learning more about investing in stocks

What is the best price to buy or sell a stock? This is the question that stock investors

are most co...

/web/common/images/retiree/retirement-investment/icon_learning_more_about_investing_in_stocks_s.jpg

youtube

Portal-Retirement

Article

01/04/2016

Learning more about investing in stocks

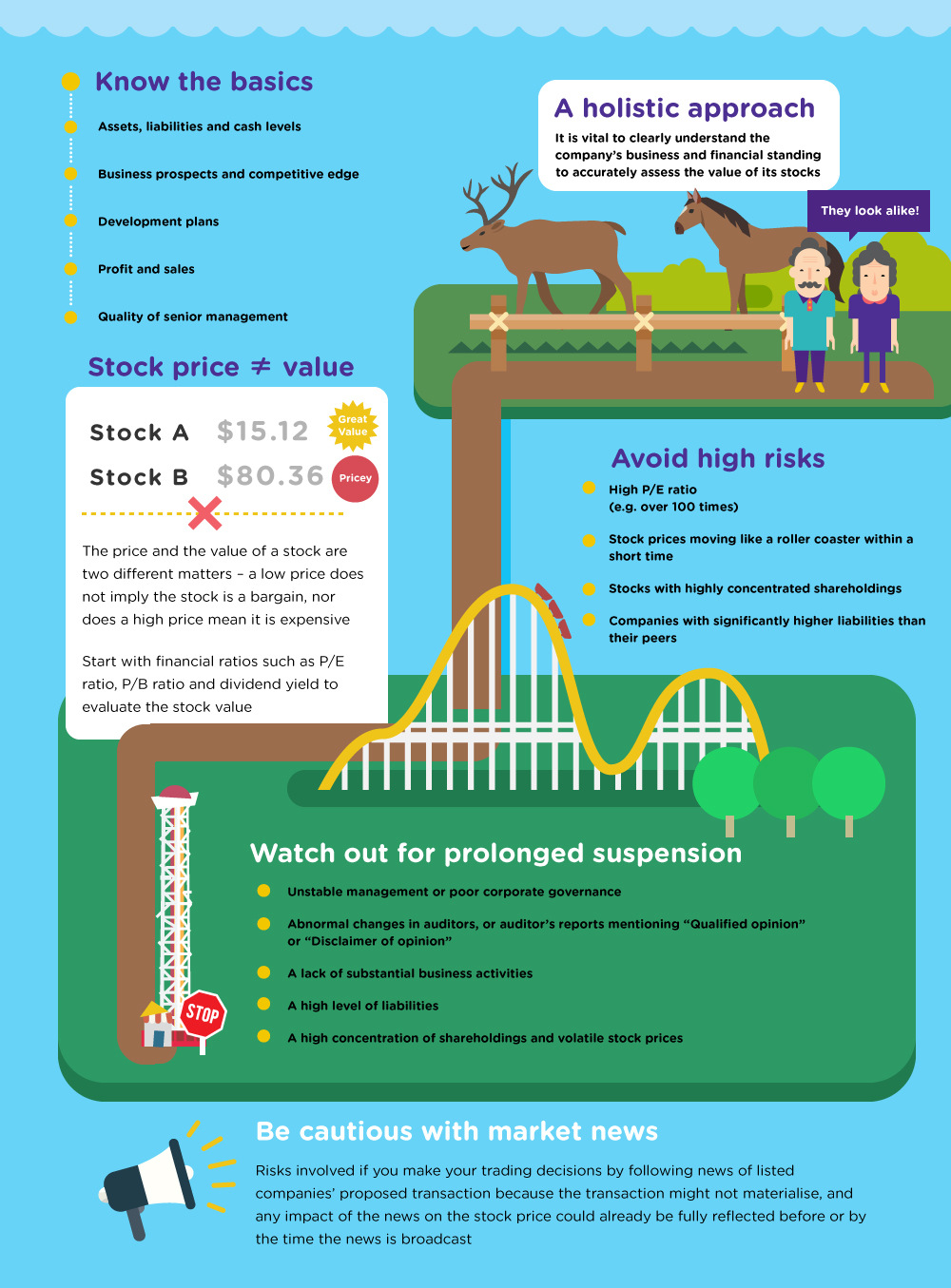

What is the best price to buy or sell a stock? This is the question that stock investors are most concerned about. Yet, there are many more areas about stock investment that deserve your attention.